What’s Contributing to Promising Outlook for Lam Research?

Lam Research’s (LRCX) revenue rose 12% and 36% in 2016 and 2017, respectively. It rose 52% in 1Q18.

Jan. 12 2018, Updated 1:45 p.m. ET

What drove revenue growth for Lam Research?

Lam Research’s (LRCX) revenue rose 12% and 36% in 2016 and 2017, respectively. It rose 52% in 1Q18. Taiwan, Japan, China, and Southeast Asia drove growth in 2016, offset by Korea, the United States, and Europe.

Every geographic region contributed to 2017 growth, offset by China and Southeast Asia.

How much did EPS rise?

Lam Research’s gross margin rose 15%, 38%, and 60% in 2016, 2017, and 1Q18, respectively. Its operating expenses increased 3%, 10%, and 14% in 2016, 2017, and 1Q18, respectively. As a result, its operating income rose 36%, 77%, and 119% in 2016, 2017, and 1Q18, respectively. Its adjusted operating income rose 24%, 63%, and 100%, respectively.

Other expense increased in 2016 before decreasing in 2017 and 1Q18. Its adjusted net income rose 25%, 64%, and 95% in 2016, 2017, and 1Q18, respectively. Its diluted EPS (earnings per share) rose 26%, 57%, and 91% in 2016, 2017, and 1Q18, respectively. Share buybacks enhanced its 2016 EPS.

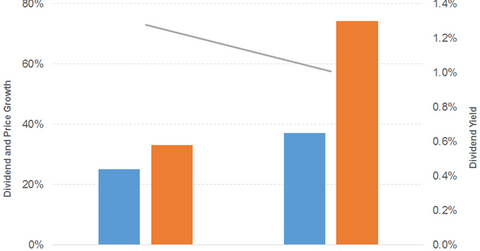

Dividend and price growth

LRCX’s dividend per share rose 25% and 37% in 2016 and 2017, respectively. Prices rose 33% and 74% in 2016 and 2017, respectively. That led to a downward sloping dividend yield curve. A forward PE (price-to-earnings) ratio of 12.5x and a dividend yield of 1.1% compare to a sector average forward PE ratio of 19.1x and a dividend yield of 1%.

How does LRCX compare to the broader indexes?

The S&P 500 (SPX-INDEX) (SPY) offers a dividend yield of 2.2%, a PE ratio of 23.4x, and a YTD (year-to-date) return of 19.6%. The Dow Jones Industrial Average (DJIA-INDEX) (DIA) has a dividend yield of 2.2%, a PE ratio of 22.3x, and a YTD return of 25.1%. The NASDAQ Composite (COMP-INDEX) (ONEQ) has a PE ratio of 28.2x and a YTD return of 24.8%.

What’s the revenue and EPS outlook?

Lam Research is being projected to have a 29% revenue growth in 2018. Its diluted EPS is being projected to rise 46% in 2018.