Why Consumer Expectations Continued to Increase in November

Consumer expectations for business conditions Average consumer expectations for business conditions form the only component of the Conference Board LEI (Leading Economic Index) that is not a leading indicator. Consumer expectations are based on two separate surveys. One survey is conducted by the University of Michigan and Reuters, while the second survey is conducted by […]

Jan. 5 2018, Updated 10:34 a.m. ET

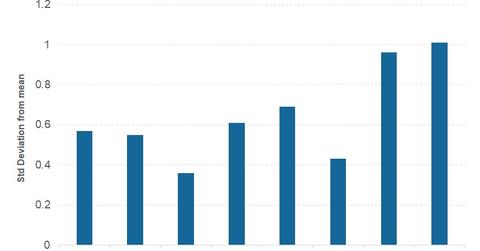

Consumer expectations for business conditions

Average consumer expectations for business conditions form the only component of the Conference Board LEI (Leading Economic Index) that is not a leading indicator. Consumer expectations are based on two separate surveys. One survey is conducted by the University of Michigan and Reuters, while the second survey is conducted by the Conference Board. The difference between these surveys is the time period for future expectations. Whereas the University of Michigan–Reuters survey collects consumer expectations for 12 months ahead, the Conference Board survey records consumer expectations six months ahead. The average of both surveys is used in the LEI.

Recent data

In November’s Conference Board LEI, average consumer expectations for business conditions stood at 1.0, another sharp month-over-month increase, likely due to the prospect of tax cuts and improving employment conditions. An increase in consumer expectations is a positive sign for the economy, potentially leading to higher spending (XRT) and a higher inflation (TIP) rate.

Conclusion

The LEI is considered one of the best predictors of business cycle changes. The November results do not signal concerns about the future of the US economy and suggest that the current expansionary cycle could continue. The recently announced tax reform is likely to boost the US economy further, at least in the short term—the LEI may continue to improve in the next month.

From an investor point of view, the market (SPY) outlook remains positive, backed by optimism due to tax cuts. However, volatility (VXX) in fixed income (BND) markets is likely to continue as rate hike uncertainty and yield spreads continue to grow.