Why Bill Ackman’s Pershing Square Had a Rough 2017

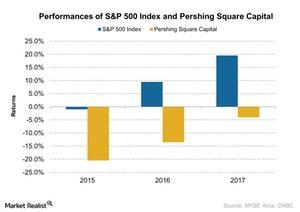

Bill Ackman’s Pershing Square Capital Management saw negative returns in 2017 for the third consecutive year.

Jan. 9 2018, Updated 7:37 a.m. ET

Bill Ackman’s Pershing Square Capital Management

Investor Bill Ackman is well known for various investment strategies and has taken activist positions in several stocks in the past two years.

However, his firm, Pershing Square Capital Management, saw negative returns in 2017 for the third consecutive year, according to CNBC. His firm returned -20.5% in 2015, -13.5% in 2016, and -4% in 2017. In comparison, the broader S&P 500 Index (SPX-INDEX) (SPY) returned 19.5% in 2017.

The poor performance in 2017 was mainly due to the following reasons:

- a ~$4 billion loss after selling Valeant (VRX) stock

- the negative effect of the lawsuit related to the Allergan acquisition and settlement costs

These factors hurt Pershing Square Capital’s overall performance in 2017. In 2015 and 2016, the firm’s short position in Herbalife (HLF) and Ackman’s defeat in the ADP proxy battle hurt the firm.

In the next part of this series, we’ll analyze how its Valeant Pharmaceuticals position affected Pershing Square Capital in 2017.