Behind Novartis’s 4Q17 Earnings: Why Some Expect Revenue Growth

Analysts expect Novartis’s revenues to rise ~3.9% to $12.8 billion in 4Q17, driven by growth in operating revenues across all three segments.

Jan. 22 2018, Updated 10:00 a.m. ET

Novartis’s revenue estimates

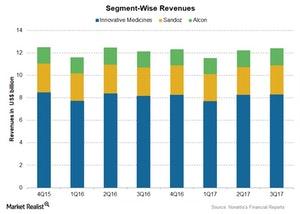

Analysts expect Novartis’s (NVS) revenues to rise ~3.9% to $12.8 billion in 4Q17, following growth in operating revenues across all three segments during the quarter. For fiscal 2017, analysts expect revenues to rise ~1.3% to ~$49.2 billion, compared with its 2016 revenues of ~$48.5 billion.

The above chart compares NVS’s segment-wise revenues over the past few quarters.

Segment-wise expectations 4Q17

Novartis’s business is divided into the following three business segments:

- Innovative Medicines, which includes prescription pharmaceutical products and oncology products

- Sandoz, NVS’s generic pharmaceuticals business

- Alcon, NVS’s eye care business

The Innovative Medicines segment’s revenues are expected to report growth in revenues in 4Q17, following the rise in sales of respiratory products like Ultibro Breezhaler, and Xolair. The segment expects to see an increase in the sales of neuroscience products like Gilenya, an increase in the sales of cardio-metabolic products like Entresto, and an increase in the sales of immunology products, dermatology products, and some of the oncology products.

Sandoz and Alcon

Sandoz, the generic pharmaceuticals segment, is expected to report growth in revenues for 4Q17, following the increase in the sales of the drug Zarxio, biopharmaceutical products, and biosimilars in outside the US market. However, the lower sales from the US markets will likely partially offset this growth.

Alcon, the eye care division, is expected to report a rise in revenues for 4Q17, following the increase in the sales of both surgical products and vision care products during the quarter.

Notably, the VanEck Vectors Pharmaceutical ETF (PPH) has 4.7% of its total investments in Novartis AG (NVS), 4.9% in Novo Nordisk ADR (NVO), 4.9% in AbbVie (ABBV), and 5.1% in Merck (MRK).