What’s BP’s Valuation?

BP (BP) is now trading at a forward PE (price-to-earnings ratio) of 16.6x, above its peer average of 16.5x.

Dec. 29 2017, Updated 7:30 a.m. ET

BP’s valuations

In the earlier part of this series, we discussed BP’s (BP) short interest trend. In this part, we’ll examine BP’s forward valuations compared to its peers.

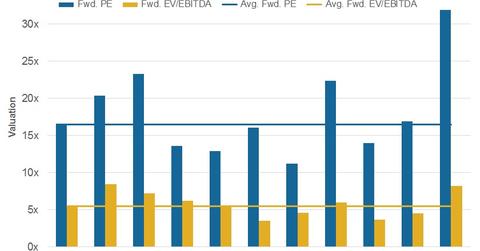

BP (BP) is now trading at a forward PE (price-to-earnings ratio) of 16.6x, above its peer average of 16.5x. ExxonMobil (XOM), Chevron (CVX), PetroChina (PTR), and Suncor Energy (SU) are also trading above the average PE at 20.3x, 23.3x, 22.4x, and 31.9x, respectively. On the other hand, peers such as Royal Dutch Shell (RDS.A), Total (TOT), and Petrobras (PBR) are trading below the average PE at 13.6x, 12.9x, and 11.2x, respectively.

BP (BP) is currently trading at the forward EV-to-EBITDA of 5.6x, again above the peer average of 5.5x.

Why have BP’s valuations crossed over its peer averages?

In the preceding years, BP’s valuations have stood at a discount to both the peer averages likely because of the blow to its financials due to the Gulf of Mexico oil spill charges and the impact of lower oil prices. These trends also led to quite an increase in BP’s debt levels. Its total debt-to-capital ratio as well as net-debt-to-EBITDA ratio rose above the peer average.

However, now the situation seems to be improving. BP’s disciplined financial framework has given it hope that BP’s cash flow and leverage position can improve. The rising valuation that the market is assigning to BP is likely due to BP’s aim to not only survive the oil price cycle but also prepare for future growth. Its focus on stronger financials and earnings, aimed at providing returns even at lower oil price range, attests to this.

Plus, the robust upstream project pipeline is likely to add to the total production. The company has started seven mega upstream projects this year. Thus, the company’s strategy of optimizing capex, reducing cost structure, selling non-core assets, plus its robust upstream pipeline could improve its financial position.