US Crude Oil Prices Could Remain below $58 Next Week

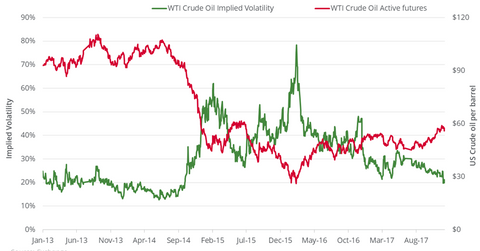

On December 7, 2017, US crude oil’s implied volatility was 20% or ~1.1% less than its 15-day average. On December 1, the implied volatility fell to 19.8%.

Dec. 11 2017, Updated 7:31 a.m. ET

Implied volatility

On December 7, 2017, US crude oil’s implied volatility was 20% or ~1.1% less than its 15-day average. On December 1, the implied volatility fell to 19.8%—the lowest since September 30, 2014.

US crude oil (USL) (DBO) (OIIL) futures settled at their 12-year low on February 11, 2016. On the same day, the implied volatility was 75.2%. From February 2016 to date, there has been more than a 100% rise in oil prices. However, the implied volatility fell 73.4%. This type of an inverse relationship can generally be observed between crude oil prices and its implied volatility in the chart above.

Oil prices

With a probability of 68% on December 8–14, 2017, US crude oil futures could close between $55.12 and $58.26 per barrel. These price limits could be useful for traders. For this model, the prices are assumed to be normally distributed using oil’s implied volatility of 20%.

On December 7, 2017, US crude oil January 2018 futures settled at $56.69 per barrel. While the upside beyond $58 is limited, any additional fall from this level might be a concern for equity indexes like the S&P 500 Index (SPY) and the Dow Jones Industrial Average Index (DIA). In Part 2, we highlighted the short-term relationship between equity indexes and oil.

Energy ETFs discussed in the previous parts and others like the Fidelity MSCI Energy ETF (FENY) could fall if oil prices decline.