Understanding Sanofi’s Revenues by Segment in 3Q17

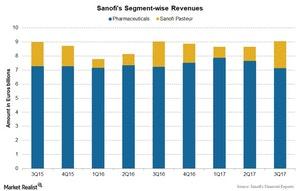

Sanofi reports its business in two segments: Human Pharmaceuticals and Sanofi Pasteur, or the Human Vaccines segment.

Nov. 14 2017, Updated 2:35 p.m. ET

Sanofi’s business segments

Sanofi’s (SNY) business includes products from specialized therapeutics, generic products, human vaccines, and consumer healthcare products. The company reorganized its business in 2016, with further exchanges in its animal health business and consumer healthcare business in 2017.

At constant exchange rates and constant structure, the company reported a 0.2% fall in revenues during 3Q17.

Segment-wise performance 3Q17

Sanofi reports its business in two segments: Human Pharmaceuticals and Sanofi Pasteur, or the Human Vaccines segment.

The Human Pharmaceuticals segment includes revenues from the following franchises:

- Sanofi Genzyme

- diabetes and cardiovascular

- general medicines

- emerging markets

- consumer healthcare

The Human Pharmaceuticals segment reported a 3.2% YoY (year-over-year) rise in revenues at constant exchange rates to 7.14 billion euros for 3Q17. Sanofi Pasteur includes revenues from the following franchises:

- human vaccines (including the adult booster vaccines)

- influenza vaccines

- meningitis and pneumonia vaccines

- polio/pertussis/HIB vaccines

- travel and other endemics vaccines

Sanofi Pasteur reported an 11% YoY rise in revenues at constant exchange rates to 1.92 billion for 3Q17.

Notably, the VanEck Vectors Pharmaceutical ETF (PPH) has ~88% of its total investments in pharmaceutical companies, with 6.2% in AbbVie (ABBV), 5.1% in Bristol-Myers Squibb (BMY), 4.7% in Eli Lilly (LLY), and 4.6% in Sanofi ADR (SNY).