Rise in Natural Gas Impacts Natural Gas ETFs

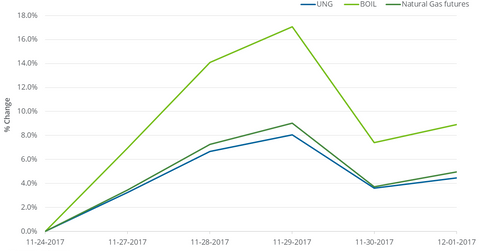

On November 24–December 1, 2017, the United States Natural Gas Fund (UNG), that follows near-month natural gas futures contracts, rose 4.5%.

Dec. 4 2017, Published 10:37 a.m. ET

ETFs that track natural gas

On November 24–December 1, 2017, the United States Natural Gas Fund (UNG), that follows near-month natural gas futures contracts, rose 4.5%. Between these two dates, natural gas January 2018 futures rose 5%.

The ProShares Natural Gas ETF (BOIL) rose 8.9%. In fact, BOIL is supposed to deliver twice the daily changes of the Bloomberg Natural Gas Subindex. It outperformed UNG.

From the 17-year low

Between March 3, 2016, and December 1, 2017, natural gas (GASL) (GASX) (FCG) active futures rose 86.8%. On March 3, 2016, US natural gas active futures fell to the lowest closing price in 17 years. UNG rose 5.4%, while BOIL fell 17% between these two dates.

The negative roll yield is an important factor for these ETFs’ underperformance. We discussed the roll yield in the previous part.

On December 1, 2017, except the January 2018 futures contract, the prices of natural gas futures contracts to May 2018 were in a descending pattern. The pattern could have a positive impact on the ETFs discussed above.

The compounding effect of daily price fluctuations could also be behind the difference in BOIL’s returns compared to its expected returns.