Rate Hike Could Move Precious Metals and Miners

Investors have their eyes set on the interest rates. A rise in the interest rates causes the demand for precious metals to fall.

Dec. 6 2017, Updated 7:33 a.m. ET

Fed’s meeting

Investors have their eyes set on the interest rates, which might move during the coming week. The Fed’s rate hike seems to be pretty certain. A rise in the interest rates causes the demand for precious metals like gold and silver to fall. Precious metals are all non-yield bearing assets. Rising interest rates have a negative impact on precious metals’ demand.

Concerns about the tax bill could benefit precious metals because their demand could rise. The market has been waiting for a decisive move on the tax bill. On the geopolitical front, unrest in North Korea could also be positive for gold. North Korea tested its most advanced intercontinental ballistic missile, although gold continues to trade in a narrow range.

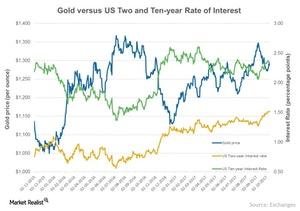

Interest rates versus gold

The comparative performance of gold and interest rates is shown in the above chart. Rising yields cause discomfort for precious metal investors. Precious metal prices are impacted negatively.

A higher rate would impact precious metals, mining shares, and funds. Precious metal funds like the famous SPDR Gold Shares (GLD) and the Physical Swiss Gold Shares (SGOL) could also see lower prices if the rate hike takes place. Analysts expect at least a short-term fall in precious metal funds after the interest rate rises.

Mining shares that experienced losses include Alamos Gold (AGI), Goldcorp (GG), B2Gold (BTG), and Agnico-Eagle Mines (AEM). They have seen a five-day trailing loss of 5%, 3.3%, 2.3%, and 2.2%, respectively.