Where Are Precious Metal Spreads Moving?

In this part of the series, we’ll look at the gold-silver spread, the gold-platinum spread, and the gold-palladium spread.

Dec. 5 2017, Updated 5:30 p.m. ET

Spread reading

When we take a close look at precious metals and their relative price movements, we should also briefly analyze the spread reading for these metals. Gold is the most dominant among the four precious metals. The other three metals react according to the price movements of gold.

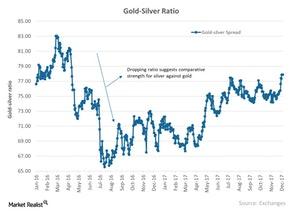

In this part of this series, we’ll look at the gold-silver spread, the gold-platinum spread, and the gold-palladium spread. The gold-silver spread measures the number of silver ounces it requires to buy a single ounce of gold. Similarly, the platinum and palladium spreads to gold measure the number of platinum and palladium ounces needed to buy one ounce of gold.

Rise or fall

The fall in these spreads indicates the relative strength for secondary metals such as silver, platinum, and palladium and the weakness of gold. The gold-silver, gold-platinum, and gold-palladium spreads were 77.9, 1.4, and 1.3, respectively, as of December 4, 2017. Their RSI (relative strength index) levels are 85, 48, and 45, respectively. An RSI above 70 indicates a fall in price, while a level below 30 indicates a probable rise in price.

As you can see in the above chart, the gold-silver spread fell in mid-2016, which suggests a comparative strength for silver against gold.

Among the mining funds that closely track precious metals are the iShares Silver Trust (SLV), the ETFS Physical Platinum (PPLT), and the ETFS Physical Palladium (PALL). They have YTD (year-to-date) gains of 2.2%, 2.3%, and 45.2% respectively.

The mining shares that continue to have YTD gains are B2Gold (BTG), Gold Fields (GFI), Randgold Resources (GOLD), and Buenaventura Mining (BVN). They’ve risen 9.7%, 34.3%, 19.6%, and 21.8%, respectively.