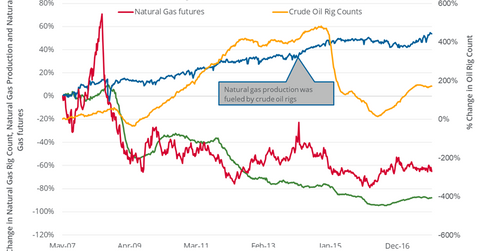

Why the Oil Rig Count Could Be a Concern for Natural Gas Bulls

In the week ended December 22, the natural gas rig count was 88.5% below its record high of 1,606 in 2008.

Dec. 27 2017, Updated 7:34 a.m. ET

Natural gas supplies

In the week ended December 22, the natural gas rig count was 88.5% below its record high of 1,606 in 2008. But in spite of such a large fall, the natural gas supplies have been rising since 2008. Often, natural gas is an outcome of oil drilling. So, the oil rig count could explain the rise in natural gas supplies.

Last week, the US oil rig count was unchanged at 747. But, on December 26, 2017, US crude oil (USL) active futures settled at $59.97 per barrel, their highest closing price in 2017. Higher oil prices could increase the US oil rig count and possibly lead to an upsurge in natural gas supplies into 2018, a concern for natural gas bulls.

EQT (EQT), Southwestern Energy (SWN), Cabot Oil & Gas (COG), Range Resources (RRC), and other natural-gas-weighted stocks could fall if natural gas prices continue to fall.

Natural gas rig count

In the week ended December 22, there was a rise of just one in the natural gas rig count. But at 184, the natural gas rig count was at its two-month high. Over this period, natural gas prices fell 9.3%. So, a further rise in the natural gas rig count could be another worry for natural gas bulls.