What Put Coeur Mining in 2nd Place?

Right now, of the nine Wall Street analysts covering CDE stock, according to Thomson Reuters, 78% recommend a “buy,” while 22% recommend a “hold.”

Nov. 20 2020, Updated 11:11 a.m. ET

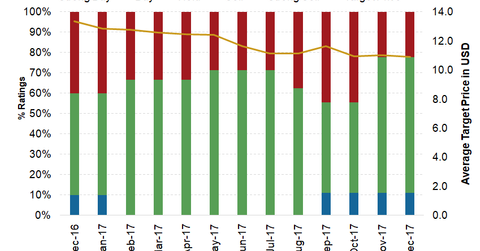

Analyst recommendations for CDE

Coeur Mining (CDE) is the largest US-based primary silver producer and a significant gold producer. In general, Coeur Mining has higher leverage with regard to changes in the precious metal prices, mainly due to its relatively higher costs compared with peers (SIL).

Right now, of the nine Wall Street analysts covering CDE stock, according to Thomson Reuters, 78% recommend a “buy,” while 22% recommend a “hold.” The stock has no “sell” recommendations.

The implied upside potential for CDE stock, based on its target price of $10.9, is 53.2%. Its close peers’ upside potentials are as follows:

- Hecla Mining (HL): 48.9%

- First Majestic Silver (AG): 84.76%

- Tahoe Resources (TAHO): 65.1%

- Pan American Silver (PAAS): 43.6%

While almost all major silver miners have seen huge declines in their stock prices in 2017, analysts haven’t been downgrading at a corresponding pace. This has resulted in significant upside potentials for these miners.

Coeur Mining’s target price has seen a downward revision of 18% in 2017 YTD (year-to-date), mainly due to the company’s weak operational performance.

Returns for CDE

Coeur Mining (CDE) stock has lost 22% of its stock value YTD as of December 11, 2017, significantly underperforming the silver miner index (SIL) as well as gold miner index (GDX). Its production growth has suffered in 2017 due to lower grades at many of its mines, and its costs have also been higher YoY (year-over-year).

Valuations

Coeur Mining’s forward EV-to-EBITDA (enterprise value to earnings before interest, tax, depreciation, and amortization) multiple is now 5.3x, which reflects a premium of 12.0% to the average multiple of primary silver peers. Its EBITDA estimates have kept pace with its YTD stock decline, and this has kept its forward multiple almost the same as it was at the beginning of the year.

The stock has several catalysts, including the Rochester expansion, which could lead to cost reductions and the generation of free cash flow, which would be positive for the company’s multiple.

To read more about Coeur Mining’s outlook, read the series After Weak 2017, Can Coeur Mining Reverse Its Fortunes in 2018?