A Look at the Rig Count and Natural Gas

On December 15, 2017, the natural gas rig count was 88.6% lower than its record high in 2008.

Nov. 20 2020, Updated 12:38 p.m. ET

Important factor for natural gas supplies

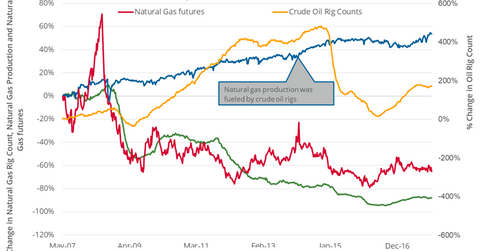

On December 15, 2017, the natural gas rig count was 88.6% lower than its record high in 2008. However, this large fall in the natural gas rig count didn’t stop the rise in natural gas supplies.

Natural gas is often found while drilling for oil in the shale regions. The large-scale drilling of oil from the shale regions in the last decade has increased natural gas supplies as well.

In the last week, the US oil rig count fell by four rigs and stood at 747. However, this level is just 21 rigs from its three-year high reached on August 11, 2017. In 2017 year-to-date, the average US crude oil (USL) active futures closing price approached the ~$50.61 level compared to the ~$43.47 level in 2016.

During this period, rigs drilling for oil have increased by 39.4%. So, higher oil prices would likely increase US oil production from the shale regions. Natural gas supplies could also rise in the near term. We already discussed the EIA’s DPR (Drilling Productivity Report) in the previous article.

Natural gas–weighted stocks like EQT (EQT), Southwestern Energy (SWN), Cabot Oil & Gas (COG), and Range Resources (RRC) may be negatively impacted by this development. These stocks closely follow natural gas prices based on recent correlations.

Natural gas rig count

On December 15, the natural gas rig count rose by three to 183—its highest level since October 20, 2017. Since this day, the active natural gas futures have fallen 7.7%.

A higher natural gas rig directly hints at rising potential supply and would be a source of trouble for natural gas bulls.