Here’s What Drove the Euro Higher Last Week

The euro (FXE) closed the week ended December 22, 2017, at 1.1864, appreciating 0.94% against the dollar (UUP).

Dec. 26 2017, Updated 1:45 p.m. ET

Euro gained from strong ECB outlook

The euro (FXE) closed the week ended December 22, 2017, at 1.1864, appreciating 0.94% against the dollar (UUP). The gains in the euro were motivated by the positive outlook from the ECB (European Central Bank) and mixed economic data in the previous week. Recent economic reports indicated that the German price index and trade activity have slowed down in recent months.

The European equity markets (VGK) remained weak on the back of mixed economic data and continuing uncertainty in German politics. The German DAX (DAX) ended the week lower by 1.1%. The Euro Stoxx (FEZ) fell 0.80%, and France’s CAC fell 0.34%.

Euro speculators increase bullish bets

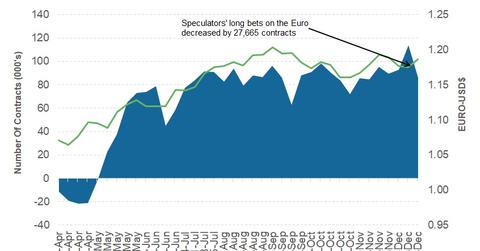

According to the latest COT (Commitment of Traders) report released on December 22, 2017, by the CFTC (Chicago Futures Trading Commission), speculators decreased their long euro positions by 27,665 contracts last week. The total net speculative bullish positions on the euro (EUFX) decreased from 113,889 contracts to 86,224 contracts in the previous week.

Outlook for the euro

The shared euro currency is likely to remain supported in the long run, backed by strong economic performance. This week, there are no major data to be reported from the European Union. The price action of the shared currency could be sideways since foreign exchange volatility tends to remain low in the last week of the year. If there is any improvement in the political situation in Germany, we could see a minor rally in the euro.

In the next part of this series, we’ll see how the British markets are reacting to developments around the Brexit.