Can Smart Beta Go Wrong?

The smart beta approach aims to benefit from market inefficiencies to deliver higher risk-adjusted returns and improve diversification.

Dec. 4 2017, Updated 2:38 p.m. ET

VanEck

BUTCHER: You said that was just one of your worries, have you any others?

Smart Beta, or Factor Investing, is also a Concern

VAN ECK: There is a great deal of money chasing what we call “smart beta”, or factor investing. (Once again, this is something that is not widely tracked, although we know it is hundreds of billions, if not, trillions of dollars.) This was not commonplace perhaps five years ago. But now, there are billions of dollars in single factor ETFs. One worries when one sees people doing something they used to not do. The concern is that it either backfires or disappoints them.

Market Realist

Allocation to smart beta is rising though risks remain

Smart beta (IWF) (IWD) is a rule-based portfolio construction process that uses an alternative weighting approach based on measures such as size, volatility, or momentum, but not price. In short, any investment strategy that is not based on price to select stocks is considered a smart beta strategy. The smart beta approach aims to benefit from market inefficiencies to deliver higher risk-adjusted returns and improve diversification.

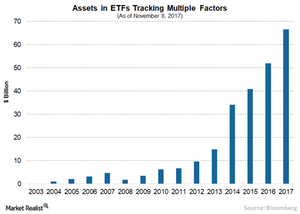

Growing popularity

According to a survey conducted by Invesco PowerShares, a growing number of investors are looking to significantly increase allocations to smart beta (VTV) (VUG) strategies due to fewer high return investment opportunities elsewhere. According to data compiled by Bloomberg Intelligence, investors have poured $66.5 billion into ETFs following static and dynamic strategies. The Invesco PowerShares survey found that allocation to smart beta strategies is expected to rise from the current level of 13% to 23% over the next three years.

Rising concerns

Although smart beta (SDY) strategies are becoming increasingly popular, the survey found that more than 50% of the respondents are not convinced about the approach but firmly believe in traditional investing methods. Many believed that investors don’t fully understand how smart beta strategies work. There might be serious consequences if investors buy factors like low volatility after they become very expensive. Besides, smart beta ETFs may have higher expenses than passive funds due to the need for periodic rebalancing, which could affect returns in the longer term.