Illumina Continued to Rise, Led the Large-Cap Stocks

Illumina (ILMN) rose by 2.7% on November 16, 2015. It rose for the fourth consecutive trading session. Illumina rose 10% in the trailing five-day period.

Nov. 18 2015, Updated 8:06 a.m. ET

IBB’s large-cap stocks fared better

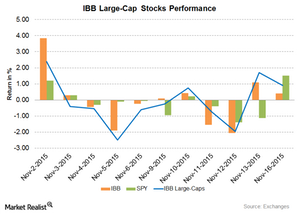

The iShares Nasdaq Biotechnology ETF’s (IBB) large-cap stocks fared better than IBB. They had a return of 0.9% on November 16, 2015. The large-cap stocks have a weight of ~69.6% in IBB’s portfolio. Out of the 15 large-cap stocks that IBB holds in its portfolio, 11 stocks gave positive returns and four stocks ended up in red. The large-cap stocks in IBB include stocks like Mylan NV (MYL), Celgene (CELG), and Regeneron Pharmaceuticals (REGN). They had returns of 2.5%, 2.5%, and 1.8%, respectively.

The above graph shows a performance comparison of IBB’s large-cap stocks, IBB, and the SPDR S&P 500 ETF (SPY). Since the beginning of November to date, IBB’s large-cap stocks underperformed IBB and SPY. They had returns of -1.3%, -0.05%, and -1.1%, respectively.

Illumina will be in the S&P 500 Index

Illumina (ILMN) rose by 2.7% on November 16, 2015. It rose for the fourth consecutive trading session. Illumina rose 10% in the trailing five-day period. The stock rose due to its inclusion in the S&P 500 Index. It will replace Sigma-Aldrich (SIAL) in the S&P 500 after the close of trade on November 18. Merck KGaA acquired Sigma-Aldrich for an estimated value of $17 billion.

Illumina closed at $170.11. It was trading above the 20-day and 50-day moving averages. However, it was trading below the 100-day moving average. The stock’s RSI (Relative Strength Index) is at 60. This indicates that the stock isn’t overbought or oversold.

Illumina witnessed a rise in its trading volume. It’s important to note that ~3.1 million shares were being traded compared to the five-day average trading volume of ~2.04 million shares per day. The trailing 12-month PE (price-to-earnings) ratio stood at 49.59x. Illumina has a book value of $13.23 per share. With its current price, the stock is trading at a PBV (price-to-book value) ratio of 12.86x. Illumina has a weight of 3.6% in IBB’s portfolio.