Assessing the Shift in CF Industries’ Product Mix

In the earlier part of this series, we discussed how shipments impacted CF Industries’ (CF) sales. From our analysis, it’s clear that a rise in selling prices remains the most important growth catalyst for the company.

Dec. 29 2017, Updated 10:32 a.m. ET

Shipment contribution

In the earlier part of this series, we discussed how shipments impacted CF Industries’ (CF) sales. From our analysis, it’s clear that a rise in selling prices remains the most important growth catalyst for the company. This is true even for companies (NANR) such as Terra Nitrogen (TNH), PotashCorp (POT), and CVR Partners (UAN).

Shifting product mix?

While the industry players wait for a turnaround in prices, companies are pursuing yet another strategy to grow within the industry that’s moving toward more specialized products that can command higher margins.

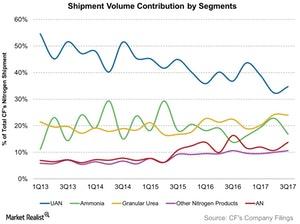

In the above chart, the shipment contribution from the UAN (urea ammonium nitrate) segment in the LTM (last 12 months) averaged 37%, which was down from 49% on an LTM basis from 3Q13. The Ammonia shipment contribution remained even at 19% while the Granular Urea shipments grew from 20% to 22% over this period.

Over this period, the company’s AN (ammonium nitrate) segment’s shipment grew from 6% to 10% and the Other segment’s shipments grew from 6% to 12%. Notably, over the same period, the sales contribution from these two segments also grew from 5% to 11% and from 4% to 8%, respectively.

The last two segments—AN and Other—include the sale to industrial customers that use nitrogen for different applications, unlike the first three segments—Ammonia, UAN, and Granular Urea—which are primarily sold as fertilizers.

Next, we’ll discuss margins.