Are Politics Holding the Euro Back?

The euro-dollar (FXE) closed the week ending December 1 at 1.19, depreciating by 0.33% against the US dollar (UUP).

Dec. 5 2017, Updated 10:32 a.m. ET

Euro troubled by German politics

The euro-dollar (FXE) closed the week ending December 1 at 1.19, depreciating by 0.33% against the US dollar (UUP). The European currency was grappling with the political uncertainty in Germany as Chancellor Angela Merkel struggled to gain support and form a coalition government. There have been reports of successful talks, but these reports were denied by the Social Democratic Party (or SPD). This continued uncertainty led to the slide in the euro and prevented the shared currency from capitalizing on the US dollar weakness.

European equity markets (VGK) all recorded losses last week troubled by political uncertainty. The German DAX (DAX) ended the week lower by 1.5%, the Euro Stoxx (FEZ) was down by 1.5%, and France’s CAC depreciated by 1.4% in the previous week.

Euro speculators decrease bullish bets

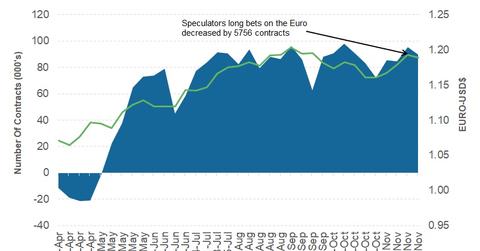

As per the latest commitment of traders report, released on December 1 by the Chicago Futures Trading Commission (or CFTC), speculator positions fell by 5,756 contracts last week. The total net speculative bullish positions on the euro (EUFX) decreased to 89,681 contracts from 95,437 contracts in the previous week.

Uncertainty surrounding German politics is likely to discourage traders from building long positions in the European currency.

Outlook for euro

Euro traders are likely to be focused on German politics throughout this week. Apart from that, the developments surrounding US tax reform are likely to support the US dollar against the euro. Economic data releases from the Euro Area this week include German industrial production and trade balance. Any positive developments in Germany could help the euro recover its losses from the previous week.

In the next part of this series, we’ll discuss how new Brexit developments are impacting the British pound.