Mosaic: What Analysts Recommend in December

Mosaic (MOS) has had a disappointing year so far compared to PotashCorp (POT) and Agrium (AGU). MOS stock significantly underperformed the S&P 500.

Dec. 18 2017, Updated 7:34 a.m. ET

Mosaic

Mosaic (MOS) has had a disappointing year so far compared to PotashCorp (POT) and Agrium (AGU). MOS stock fell 16% YTD (year-to-date), significantly underperforming the S&P 500. On December 13, 2017, Mosaic closed at $24.70.

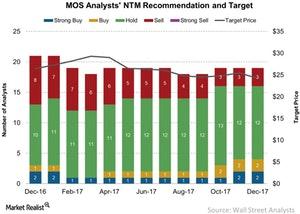

Analyst ratings

As of December 13, 2017, 18 analysts are covering MOS stock. They have a consensus mean rating of 2.67 with an overall “hold” recommendation for the next 12 months. Month-over-month, the rating changed from 2.95.

The number of analysts recommending a “strong buy” was unchanged month-over-month at two. The number of analysts recommending a “buy” was also unchanged at two for the same period.

Twelve analysts continue to recommend a “hold” on the stock, and three analysts continue to recommend a “sell.” None of the analysts have given the stock a “strong sell.”

Price target

The current consensus median price target for Mosaic is $24. That’s lower than the December 13, 2017, price of $24.70. The mean price target for the stock is $24.20 as of the same date. It was $25.50 a month earlier in November.

Analysts’ earnings revisions

Analysts have made revisions to Mosaic’s EPS (earnings per share) expectation. They’ve revised its EPS for fiscal 2017, raising it 21% to $0.97. For fiscal 2018, they revised the EPS 8.9% higher to $1.09. For fiscal 2019, they revised it 4% higher to $1.30.

Phosphate producers (MOO) such as Mosaic, PotashCorp, and Agrium faced headwinds in 2017, which could explain why they had unfavorable phosphate segment results. However, the upward analyst revision for Mosaic’s EPS may indicate an expectation of a turnaround.

In the next part, we’ll see how analysts are rating CF Industries (CF).