Your Brief Correlation Study of Major Mining Stocks Last Week

The iShares MSCI Global Gold Min (RING) and the VanEck Vectors Junior Gold Miners (GDXJ) have seen YTD (year-to-date) gains of 6.4% and 9%, respectively.

Nov. 14 2017, Published 4:36 p.m. ET

Correlation analysis

Usually, mining companies take their directional clues from gold, the generally favored precious metal, which also influences other metals as well as mining shares.

Below, we’ll assess Royal Gold (RGLD), Goldcorp (GG), Sibanye Gold (SBGL), and Gold Fields (GFI). The mining funds that have strong correlations with precious metals include the iShares MSCI Global Gold Min (RING) and the VanEck Vectors Junior Gold Miners (GDXJ), which have seen YTD (year-to-date) gains of 6.4% and 9%, respectively.

Trend reading

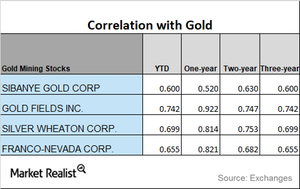

Among these four miners, Sibanye Gold has the lowest correlation with gold, while Royal Gold has the highest. All these miners except Sibanye Gold have seen upward trends in their correlations with gold. Royal Gold’s saw its correlation rise from a three-year correlation of 0.76 to a one-year correlation of 0.87.

Remember, a rise in the correlation indicates that price changes in gold should play a role in the mining stock’s price changes.

Its correlation of 0.87 suggests that in the past year, Royal Gold has been taking cues from gold ~87.0% of the time. This also means that a rise in gold leads to an increase in Royal Gold ~87.0% of the time.

Remember, the correlation trends among mining stocks can make a directional change at any given time.