Analyzing Mining Stocks’ Volatility

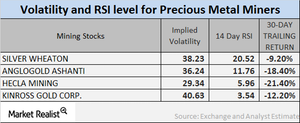

As of March 15, the volatilities of Silver Wheaton, AngloGold Ashanti, Hecla Mining, and Kinross Gold were 38.2%, 36.2%, 29.3%, and 40.6%, respectively.

March 20 2017, Updated 9:08 a.m. ET

Precious metal funds

Precious metal investors tend to keep a close eye on how precious metal mining stocks perform. Mining funds such as the leveraged Direxion Daily Gold Miners (NUGT) and the ProShares Ultra Gold (AGQ) rose substantially at the beginning of 2017 due to precious metals’ recent revival. Lately, funds and mining shares suffered.

Monitoring large mining stocks’ implied volatilities is important. We should also watch their RSI (relative strength index) levels, particularly in the wake of changing precious metal prices. Below, we’ll look at Silver Wheaton (SLW), AngloGold Ashanti (AU), Hecla Mining (HL), and Kinross Gold (KGC).

Implied volatility

Call-implied volatility takes into account the changes in an asset’s price due to variations in the price of its call option. During times of global and economic turbulence, volatility is higher than in a stagnant economy.

As of March 15, the volatilities of Silver Wheaton, AngloGold Ashanti, Hecla Mining, and Kinross Gold were 38.2%, 36.2%, 29.3%, and 40.6%, respectively. Remember, mining companies’ volatility is often higher than precious metals’ volatility.

RSI levels

A 14-day RSI (relative strength index) above 70 indicates the possibility of downward movement in a stock’s price. A level below 30 shows the possibility of an upward movement in a stock’s price.

The RSI levels of the four mining giants mentioned above rose due to higher stock prices. Silver Wheaton, AngloGold Ashanti, Hecla Mining, and Kinross Gold had RSI levels of 20.5, 11.7, 6, and 3.5, respectively.