Vivint Solar Reported Rise in Estimated Retained Value in 3Q17

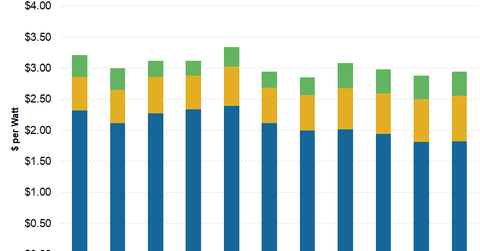

Vivint Solar (VSLR) reported a cost per watt of $2.94 for 3Q17, higher than the $2.88 it reported in 2Q17 and $3.85 in 3Q16.

Nov. 15 2017, Updated 9:25 a.m. ET

Vivint Solar’s cost per watt

Vivint Solar (VSLR) reported a cost per watt of $2.94 for 3Q17, higher than the $2.88 it reported in 2Q17 and $3.85 in 3Q16. Higher S&M (sales and marketing) and G&A (general and administrative) expenses led to an increased cost per watt on a YOY basis. For higher operational efficiency, cost per watt should be low.

A drop in solar panel prices and BOS (balance of system) costs could positively affect a company’s cost performance.

Estimated retained value

The estimated retained value is future cash flows a company expects to receive from long-term contracts and is generally discounted at 6%.

Vivint Solar’s estimated retained value has been increasing. However, since 1Q15, its quarter-over-quarter growth rate has dropped. For 3Q17, Vivint Solar reported an ERV (or estimated retained value) of $1.5 billion, which rose only 5.1% on a quarter-over-quarter basis compared to nearly 18.9% in 2Q17.

ERV is sensitive to interest rates. Thus, any rise in interest rates in the future may have a negative impact on the ERV of VSLR and other solar energy (TAN) companies like Sunrun (RUN), SunPower (SPWR), and SolarCity (SCTY).

Megawatts booked

Megawatts booked is the overall capacity of solar (TAN) energy systems sold to customers. Selling and marketing (or S&M) costs can be estimated using this metric. A decline in megawatts booked may lead to an increase in S&M costs per watt.

For 3Q17, Vivint Solar reported its megawatts booked at about 52.9 megawatts as compared to 55.4 booked during 2Q17.

In the next part, let’s take a look at Vivint Solar’s 3Q17 revenue.