How Natural Gas ETFs Are Reacting to Spike in Natural Gas

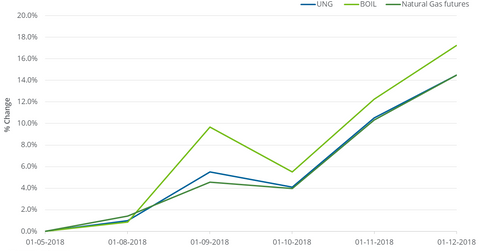

Between January 5 and January 12, 2018, the United States Natural Gas ETF (UNG), which holds positions in active natural gas futures, gained 14.5%.

Jan. 16 2018, Published 4:46 p.m. ET

Natural gas ETFs

Between January 5 and January 12, 2018, the United States Natural Gas ETF (UNG), which holds positions in active natural gas futures, gained 14.5%. That was equal to the spike in natural gas futures that week.

Last week, the ProShares Ultra Bloomberg Natural Gas (BOIL) rose 17.2%. However, its objective is to capture twice the daily fluctuations of the Bloomberg Natural Gas Subindex.

Natural gas since 2016

Between March 3, 2016, and January 12, 2018, natural gas (GASL) (FCG) (GASX) active futures rose 95.2% from their 17-year low. UNG rose 9.2%, while BOIL fell 23.1% from natural gas’s $1.64 per MMBtu (million British thermal unit) on March 3, 2016.

Investors should note that natural gas futures’ roll yield could be behind the smaller or negative returns of these ETFs compared to natural gas prices. When active futures settle below the next month’s futures, it causes the roll yield to be negative, and the ETFs could incur losses. Additionally, the compounding effect of daily price changes could make BOIL’s actual returns differ from its expected returns.

On January 12, 2018, natural gas futures contracts between February and May 2018 settled progressively lower. The ETFs could benefit from this structure, which could give a positive roll yield.