James Gorman Says China ‘Is a Gift to the World Economic Growth’

James Gorman, chair and CEO of Morgan Stanley (MS), shared his view on China (FXI) (YINN) in an interview with CNBC.

Nov. 28 2017, Updated 5:54 p.m. ET

China’s economy

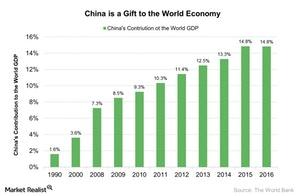

James Gorman, chair and CEO of Morgan Stanley (MS), shared his view on China (FXI) (YINN) in an interview with CNBC. He said that China “is a gift that keeps giving to world economic growth.” In 2016, China’s GDP accounted for 14.8% of the world’s total GDP.

Despite higher debt levels, China could be a savior of the world economy (ACWI). In 2015, the world’s GDP fell for the first time after the 2008 global financial crisis. But in the same year, China’s economic growth expanded, but at a weaker pace.

China’s GDP in 2017

In 3Q17, China’s GDP growth rate was at 6.8%. Overall, in the last three quarters of this year, China’s GDP growth rates were between 6% and 7%. Thus, it’s likely we could see a growth rate above 6% in the Chinese economy (MCHI) (ASHR) in the near term. The reform measures taken by the Chinese government and the central bank could help the economy to grow at a faster rate in the upcoming year. In fact, the World Bank forecasted China’s growth rate will be around 6.5% in 2017 and the global growth rate would be 2.7% in the same year.

Morgan Stanley’s investment in China

Morgan Stanley is planning to raise its stake in Morgan Stanley Huaxin Securities from 49% to 51%, according to James Gorman. China is about to introduce some new regulations that could increase foreign ownership limits. Gorman said, “that’s a sign of China opening up and behaving and acting like other major economic countries around the world.”

In the next part of this series, we’ll analyze James Gorman’s view on China’s investment in India.