Inside Buffalo Wild Wings’ Marketing Strategies

Buffalo Wild Wings is competing in the highly competitive restaurant business, wherein innovation is a must to keep up with the changing needs of customers.

April 26 2016, Updated 10:04 p.m. ET

The importance of marketing

Buffalo Wild Wings (BWLD) is competing in the highly competitive restaurant business, where innovation is necessary to keep up with the changing needs of customers. Marketing and advertising thus play crucial roles in showcasing innovations to customers. Promotions also help in increasing the traffic and transactions of the company. (“Traffic” is defined as the number of customers who make transactions at a given restaurant or restaurants.)

The company, whose mission is to “Wow people every day,” is focused on improving the experience of eating at Buffalo Wild Wings, and its marketing campaigns are built to project that aim. The company has thus implemented various methods to capture the energy of a stadium, with tabletop tablets that can entertain guests with video games, jukeboxes, trivia, and new menu items Otherwise put, BWLD is focused on improving the customer experience.

Contributions from company-owned restaurants

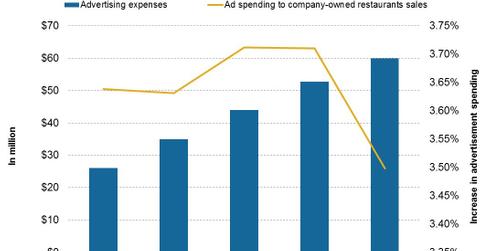

In the past five years, BWLD’s spending on advertising by company-owned restaurants has been in the range of 3.5%–3.7% of revenue generated from company-owned restaurants. In terms of dollars spent, it has increased from $26.1 million in 2011 to $60 million in 2015. The money has been utilized to run ad campaigns on televisions, radio, print media, and websites. During recent football tournaments, the company even purchased ad time during a commercial break of every game that runs into overtime.

In 2015, the company-owned restaurants of Texas Roadhouse (TXRH), Bloomin’ Brands (BLMN), and Brinker International (EAT) have contributed 0.7%, 3.7%, and 3.2%, respectively, of their revenues toward advertising.

Marketing efforts and promotions of franchisees

Franchise owners are required to pay 3.5% of their sales as a marketing fee, with 3% going to the National Advisory Fund and the remaining 0.5% spent by the franchisees directly or through co-ops.

BWLD, which makes up 0.01% of the holdings of the iShares Russell 3000 ETF (IWV), maintains a customer survey focus group as well. In these focus groups, customers provide feedback on promotions, ad campaigns, offerings, and new food items. BWLD plans to utilize these comments to enhance the customer experience further. The “B-Dubs Huddle” initiative was responsible for the introduction of tablets on the restaurant tables, including the proprietary B-Dubs TV Network and B-Dubs Radio, a radio station that features exclusive sports contents and contemporary hits.

Continue to the next part for a closer look at BWLD’s new Stadia design.