Will the Euro Regain Its Momentum this Week?

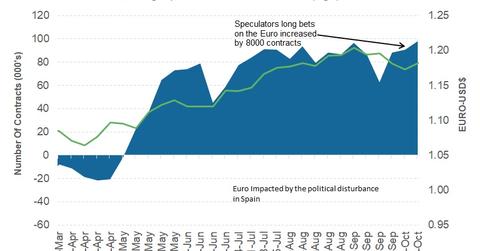

The euro-dollar (FXE) pair closed the week ending October 13 at 1.1822 against the US dollar (UUP). The shared currency managed to rebound from an 11-week low the week before, affected by political turmoil in Spain.

Oct. 16 2017, Published 5:28 p.m. ET

The euro closed weaker for a second week in a row

The euro-dollar (FXE) pair closed the week ending October 13 at 1.1822 against the US dollar (UUP). The shared currency managed to rebound from an 11-week low the week before, affected by political turmoil in Spain. There’s still a lot of uncertainty surrounding Catalonian independence, and it’s still unclear if Catalonian leaders will move ahead with their independence referendum.

European equity markets (VGK), however, remain positive, reflecting the global trend. The German DAX (DAX) ended the week up 0.28%, Euro Stoxx (FEZ) was up 0.03%, and France’s CAC was down 0.15% last week.

Euro speculators increase their bets

As per the latest “Commitment of Traders” (or COT) report released on Friday, October 13, by the Chicago Futures Trading Commission (or CFTC), speculators added to their bullish positions on the euro. The total net speculative bullish positions on the euro (EUFX) rose from 90,833 contracts through October 3 to 98,079 contracts as of October 10. What’s interesting is that large speculators haven’t been deterred by the euro’s fall in recent weeks. This level of positive positioning could mean that speculators are expecting a further rise in the euro.

Will the euro reclaim its lost peak?

Economic data scheduled to be reported from the European Union this week include the German Zew survey and the European CPI report. With that market’s focus now shifting to the European Central Bank’s monetary policy on October 26, strong data in the next two weeks could make traders believe that the ECB could announce a taper sooner than expected. This outlook could drive the euro toward the 1.20 mark this week.

In the next part of this series, we’ll discuss the opposing forces impacting the British pound.