Will Spanish Unrest Drag the Euro Lower?

The euro-dollar (FXE) closed the week ending September 29 at 1.1814 against the US dollar (UUP). German election results had a minor negative impact on the shared currency.

Oct. 2 2017, Updated 4:37 p.m. ET

The euro trended lower last week

The euro-dollar (FXE) closed the week ending September 29 at 1.1814 against the US dollar (UUP). German election results had a minor negative impact on the shared currency as markets digested the fact that Angela Merkel would continue for a fourth term but with a coalition partner. Economic data in the Eurozone was reported below expectations with a lower reading in inflation and Ifo Business Climate Index.

European equity markets (VGK), however, remained in positive territory, reflecting the global trend. The German DAX (DAX) ended the week up 1.88%, Euro Stoxx (FEZ) was up 1.51%, and France’s CAC was up 0.92% last week.

Euro speculators increase their bets

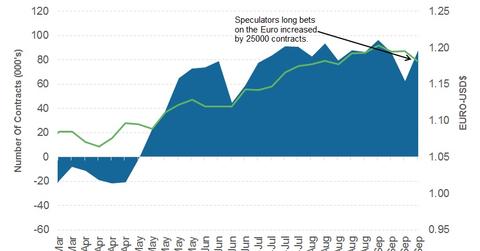

As per the latest “Commitment of Traders” (or COT) report released on Friday, September 29, by the Chicago Futures Trading Commission (or CFTC), speculators raised their bullish bets on the euro this week.

The total net speculative bullish positions on the euro (EUFX) rose from 62,753 contracts through September 19 to 88,167 contracts as of September 26.

Will Catalonia and Spain drive the euro lower?

Catalonia, part of Spain, held an independence referendum on Sunday, and 90% of the voters wanted an independent state. This news rattled the euro in the initial hours of trading on Monday, with the shared currency depreciating 0.70% on the day. The referendum, however, isn’t official. Spain will not accept the vote, but the political unrest led to selling of the euro. This political unrest could see some increased volatility, which could dry down quickly, as it wouldn’t impact the entire euro area immediately.

In terms of economic data, European inflation, retail sales, and German factory orders are key data coming out this week. The focus, however, should be on the divergent monetary policy between the United States and the European Union. Expectations from these central banks should determine the path for the euro in the medium term.

In the next part of this series, we’ll analyze the movements of the British pound last week.