What to Expect from Occidental Petroleum’s 3Q17 Revenues

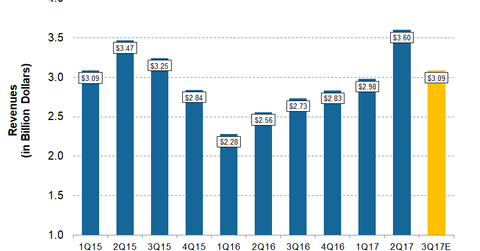

For 3Q17, Wall Street analysts expect Occidental Petroleum (OXY) to report revenues of ~$3.1 billion.

Oct. 27 2017, Updated 4:05 p.m. ET

Occidental Petroleum’s 3Q17 revenues estimates

For 3Q17, Wall Street analysts expect Occidental Petroleum (OXY) to report revenues of ~$3.1 billion. On a year-over-year basis, OXY’s 3Q17 revenues expectations are ~13% higher when compared with 3Q16 revenues of ~$2.7 billion. Sequentially, Occidental Petroleum’s 3Q17 revenues expectations are lower by ~16% when compared with 2Q17 revenues of ~$3.6 billion.

How was OXY’s 2Q17 revenues performance?

In the most recent earnings release in August 2017, OXY reported revenues of ~$3.6 billion, higher than the Wall Street analyst consensus for revenues of ~$3.0 billion. Sequentially OXY’s 2Q17 revenues are higher by ~21% when compared with 1Q17 revenues of ~$3.0 billion. Even on a year-over-year basis, OXY’s 2Q17 revenues are higher by ~41% when compared with 2Q16 revenues of ~$2.6 billion.

Despite the year-over-year decrease in Occidental Petroleum’s 2Q17 production and higher realized prices for crude oil (OIL), natural gas liquids and natural gas (UGAZ) impacted OXY’s revenues positively.

OXY’s worldwide crude oil realized price increased to $46.55 per barrel in 2Q17 compared with $39.66 per barrel in 2Q16. We’ll study OXY’s production in the next part.

OXY’s peer Devon Energy (DVN) reported revenues of ~$3.2 billion in the quarter, lower than the Wall Street analyst consensus for its revenues of ~$3.25 billion. On a year-over-year basis, DVN’s 2Q17 revenues are higher by ~27% when compared with 2Q16 revenues of ~$2.5 billion.

Understanding OXY’s revenues mix

In 2Q17, OXY’s oil and gas business reported sales of ~$1.9 billion, which means ~51% of OXY’s revenues came from crude oil (SCO), natural gas liquids, and natural gas (BOIL) production sales. Apart from upstream revenues, OXY’s chemical business contributed ~$1.3 billion, and the midstream and marketing business contributed ~$270 million to OXY’s 2Q17 revenues. OXY also reported eliminations totaling -$214 million.

Now let’s take a look at OXY’s 3Q17 production guidance.