Why Buffett Believes US Businesses Aren’t Really Hurting from the US Corporate Tax

The US economy has been improving gradually, but some businesses in the US have suffered a lot over the years.

Dec. 4 2020, Updated 10:51 a.m. ET

Buffett on the proposed corporate tax cut

The US economy (QQQ) (VOO) has been improving gradually, but some businesses in the US (IWM) have suffered a lot over the years. Improvements in domestic demand and consumer spending have been among the main helpers lately for US businesses.

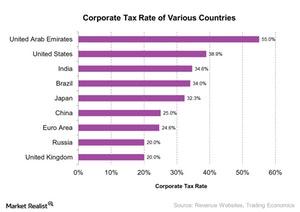

President Donald Trump promised during his election campaign that he would reduce the US corporate tax rate from 35% to 20%. Now, his administration has submitted a tax reform bill, and though hopes for passage of the tax reform bill in US Congress look slim, some are seeing improving popularity. Many market participants believe if the tax rate were reduced, it would help large corporates.

But billionaire investor Warren Buffett doesn’t hold this view, stating recently: “I don’t think any [US businesses] are non-competitive in the world because of the corporate tax rate.”

A reduction in corporate tax, others argue, would benefit shareholders, regardless of US federal deficit concerns. If the corporate tax is lower, as the argument goes, companies’ net earnings after tax would be higher, which could help businesses expand capabilities, invest in new projects, and increase shareholder value.

In the next part, we’ll analyze Warren Buffett’s view of Wells Fargo (WFC).