Wall Street’s Forecast for Flotek Industries before Its 3Q17 Earnings

On October 16, 2017, all analysts tracking Flotek Industries rated it as a “buy” or some equivalent.

Oct. 23 2017, Updated 9:07 a.m. ET

Wall Street’s forecast for Flotek Industries

In the final part of this series, we’ll look at the recent Wall Street analysts’ forecasts for Flotek Industries (FTK) before its 3Q17 earnings.

On October 16, 2017, all analysts tracking Flotek Industries rated it as a “buy” or some equivalent. None of the sell-side analysts rated it as a “hold,” a “sell,” or an equivalent.

In comparison, 60% of the analysts tracking Key Energy Services (KEG) rated it as a “buy” or some equivalent on October 16. Approximately 40% of analysts tracking KEG rated it as a “hold.” None of the sell-side analysts rated KEG as a “sell.”

FTK constitutes 0.04% of the iShares Core S&P Small-Cap ETF (IJR). The S&P 500 Index (SPX-INDEX) increased 20% in the past year versus a 66% decline in FTK’s stock price and a 20% rise in IJR during this period.

Analysts’ rating changes for FTK

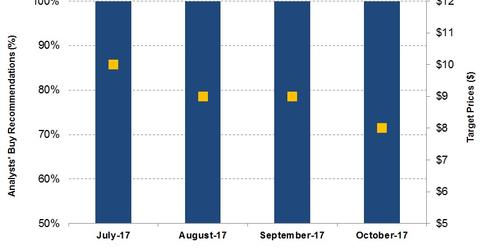

From July 16, 2017, to October 16, 2017, the percentage of analysts recommending a “buy” or some equivalent for FTK remained unchanged at 100%. Analysts’ “hold” recommendations also remained unchanged for FTK during this period.

A year ago, ~75% of the sell-side analysts recommended a “buy” for FTK.

Analysts’ target prices for FTK

Wall Street analysts’ mean target price for FTK on October 16 was $8. FTK is currently trading at ~$4.80, implying an ~68% upside at its current price. Analysts’ average target price for FTK was $9.00 a month ago.

Analysts’ target prices for FTK’s peers

Surveyed among the sell-side analysts, the mean target price for Core Laboratories (CLB) was $114.20 on October 16. CLB is currently trading at ~$94.00, implying an ~21% upside at its current price.

The mean target price as surveyed among the sell-side analysts for CARBO Ceramics (CRR) was $8.80 on October 16. CRR is currently trading at ~$6.80, implying a 29% upside at its current price.

You can learn more about the OFS industry in Market Realist’s The Oilfield Equipment and Services Industry: A Primer.