iShares Core S&P Small-Cap

Latest iShares Core S&P Small-Cap News and Updates

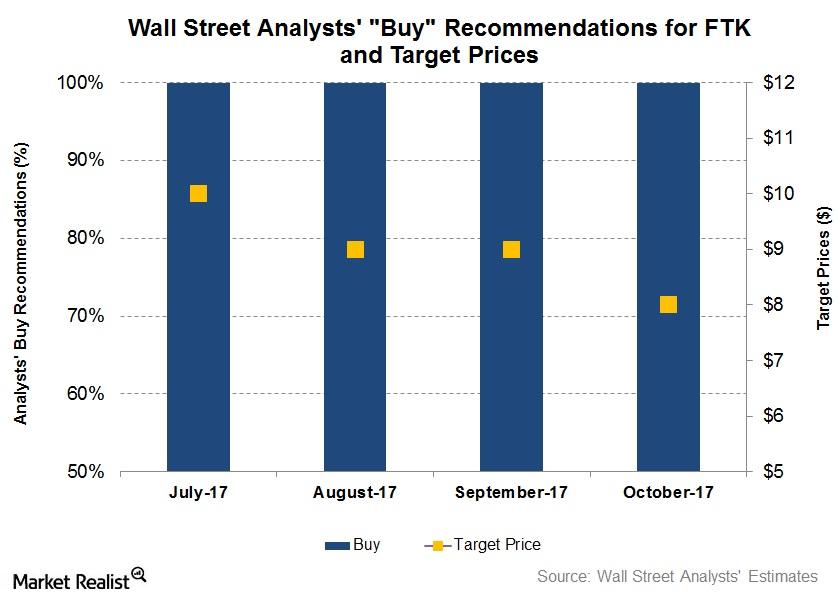

Wall Street’s Forecast for Flotek Industries before Its 3Q17 Earnings

On October 16, 2017, all analysts tracking Flotek Industries rated it as a “buy” or some equivalent.

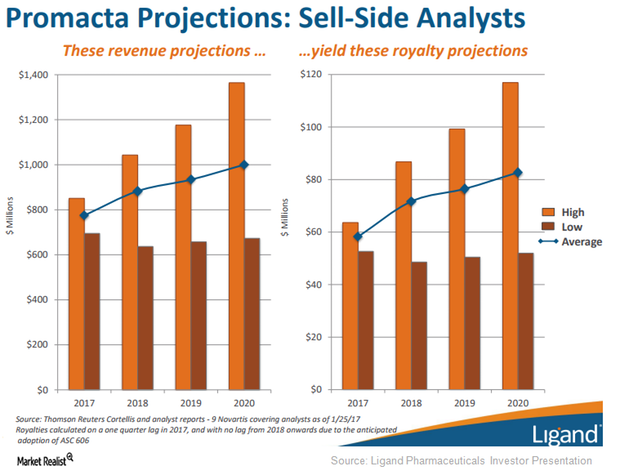

Ligand Pharmaceuticals Projects Higher Average Royalty Rate for Promacta

Ligand Pharmaceuticals (LGND) receives royalties from Novartis on Promacta’s sales according to a tiered annual payment structure.

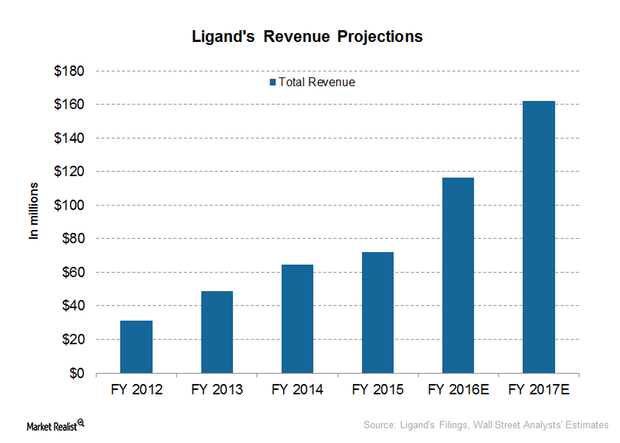

What Is Ligand Pharmaceuticals’s Expected Revenue Growth in 2016?

Ligand Pharmaceuticals (LGND) is a high-growth company with a comparatively low-risk business model. It earns most of its revenue from royalty and license fees.