Carbo Ceramics Inc

Latest Carbo Ceramics Inc News and Updates

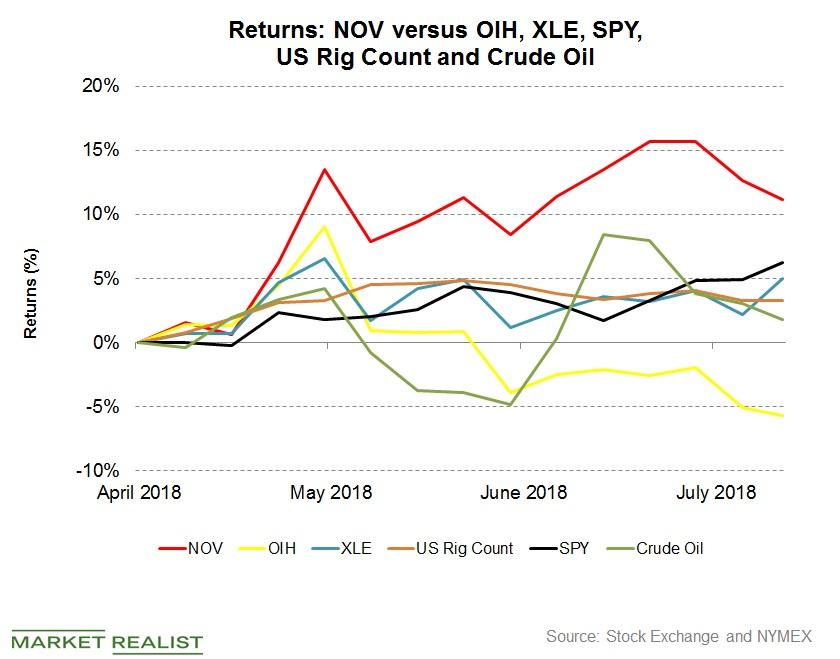

National Oilwell Varco’s Q2 2018 Earnings and the Market

Since April 26 when National Oilwell Varco released its Q1 2018 financial results, NOV stock has risen 10%.

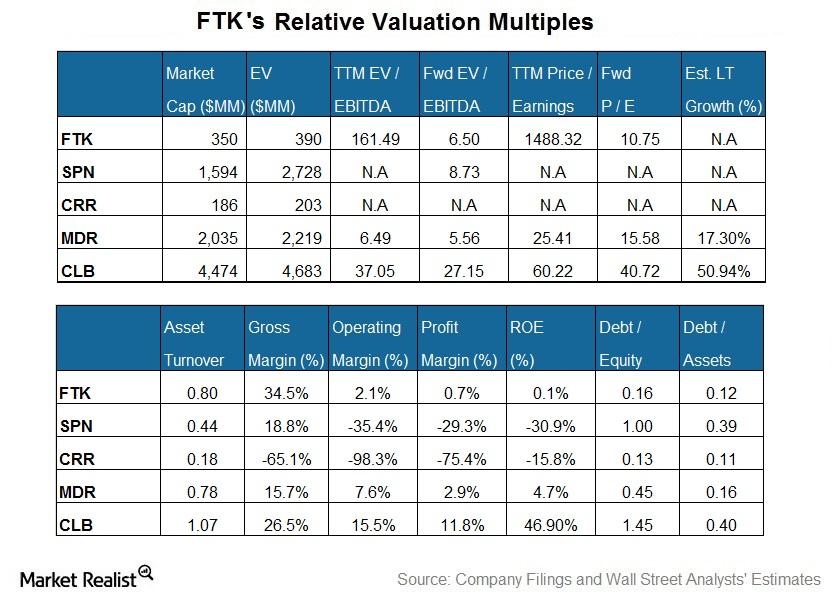

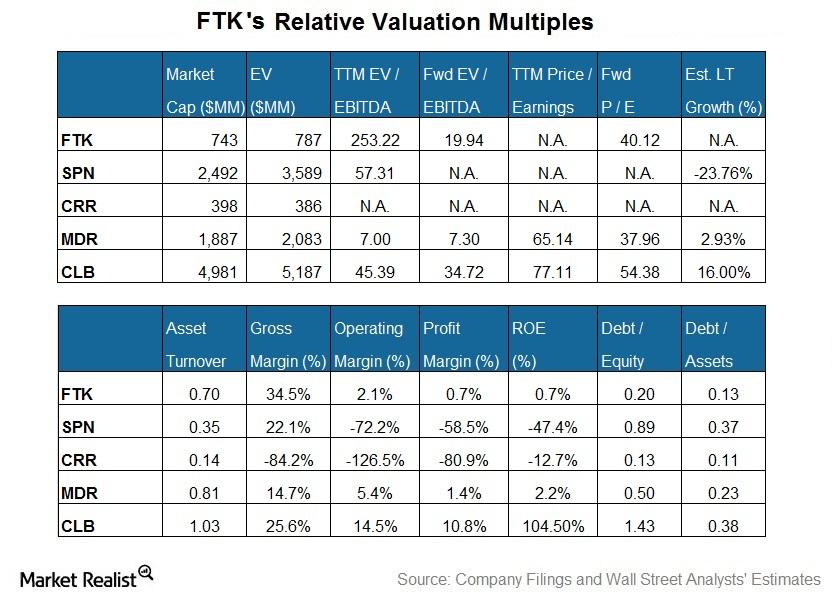

Flotek Industries’ Current Valuation versus Its Peers

Sell-side analysts expect Flotek’s adjusted EBITDA to rise sharper in the next four quarters compared to its peers.

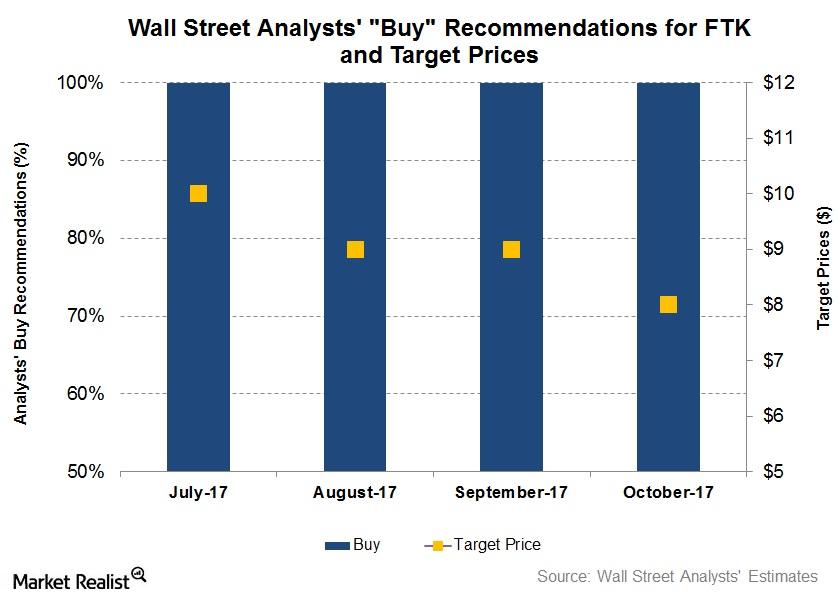

Wall Street’s Forecast for Flotek Industries before Its 3Q17 Earnings

On October 16, 2017, all analysts tracking Flotek Industries rated it as a “buy” or some equivalent.

These Energy Stocks Rose the Most Last Week

Oil field services stock CARBO Ceramics (CRR) was the biggest gainer among the energy sector stocks last week.

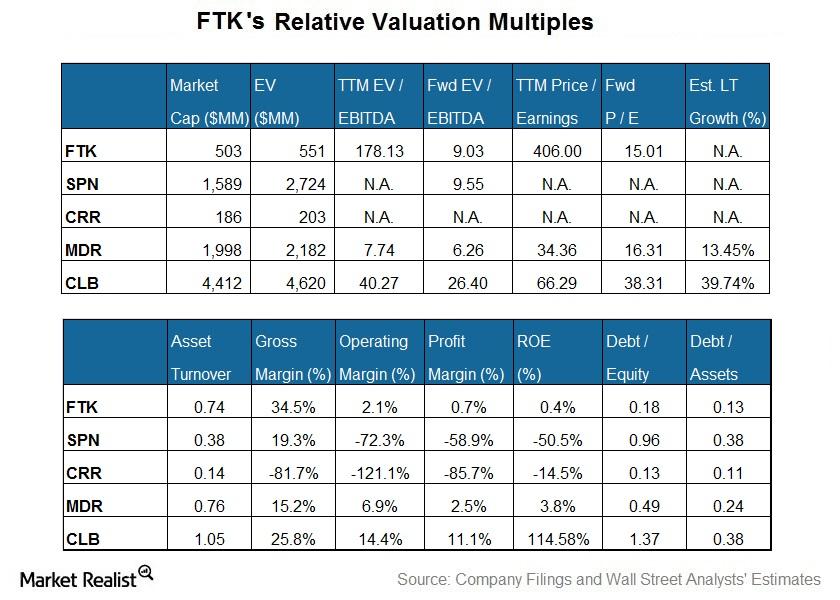

Weighing Flotek’s Current Valuation against Peers

Sell-side analysts expect FTK’s adjusted EBITDA to rise more sharply over the next four quarters than those of its peers.

What Investors Can Expect from Halliburton

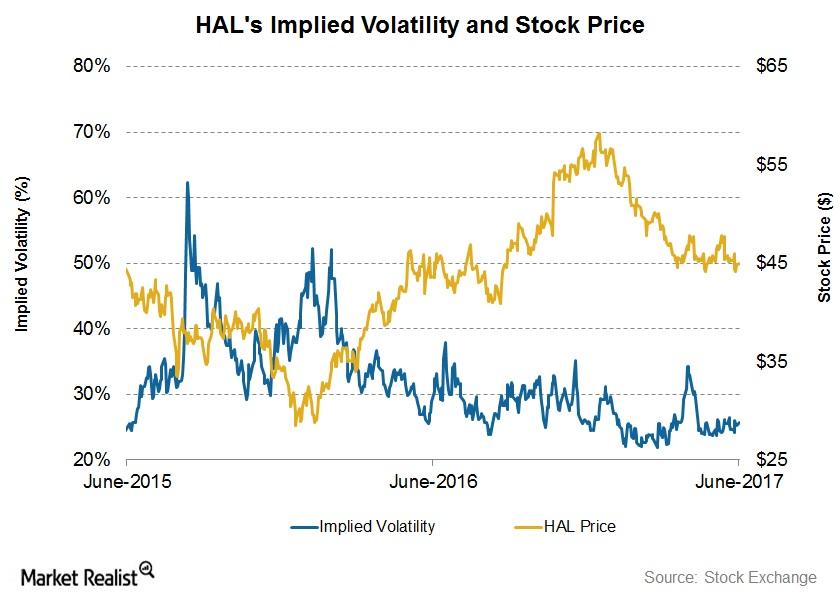

On June 13, Halliburton’s implied volatility was 24.1%. Since its 1Q17 financial results were announced on April 24, its implied volatility has fallen.

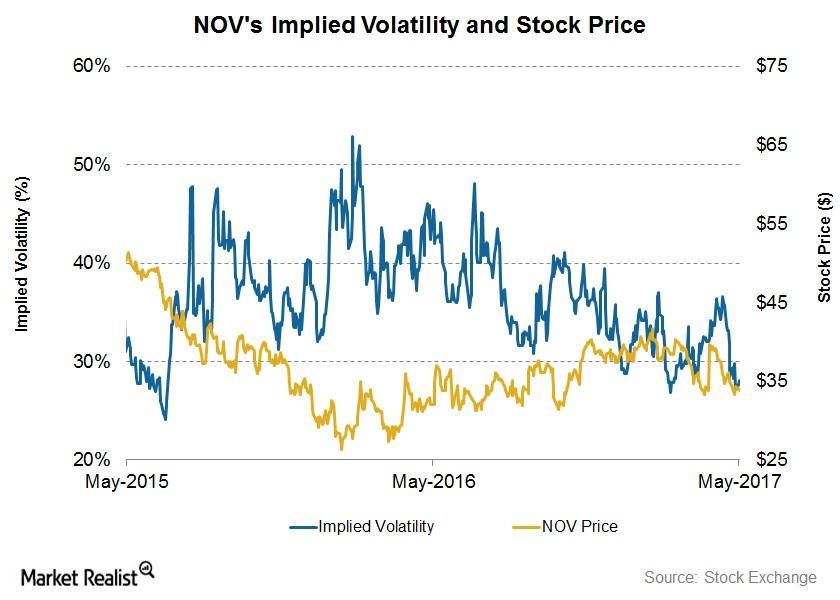

What’s National Oilwell Varco’s 7-Day Stock Price Forecast?

NOV stock will likely close between $35.11 and $32.49 in the next seven days. The stock was trading at $33.80 on May 11, 2017.

How Flotek Industries Is Valued versus Peer Stocks

Core Laboratories (CLB) is the largest company by market capitalization among our set of select oilfield services and equipment (or OFS) companies…

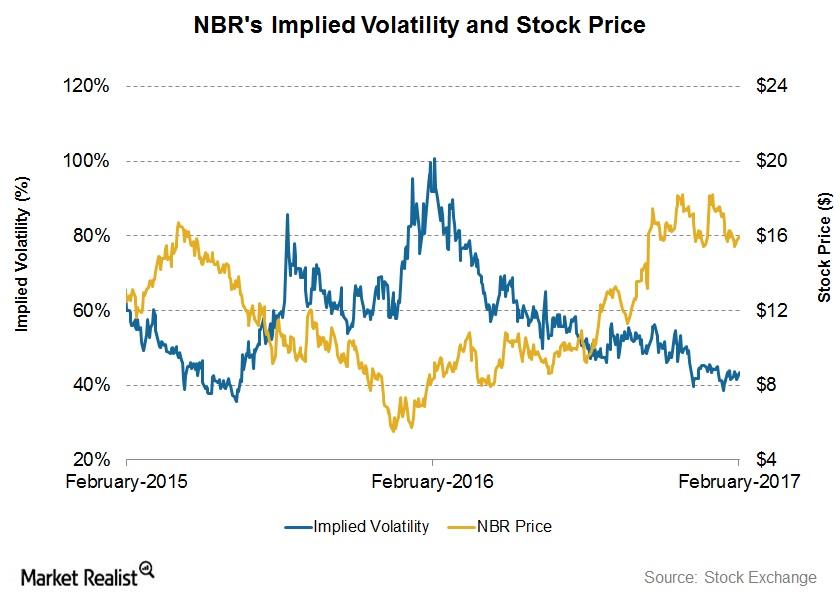

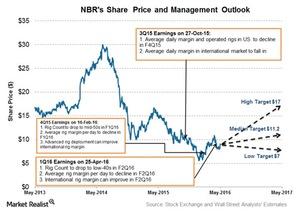

What Nabors Industries’ Implied Volatility Suggests

On February 13, 2017, Nabors Industries (NBR) had an implied volatility of 43%.

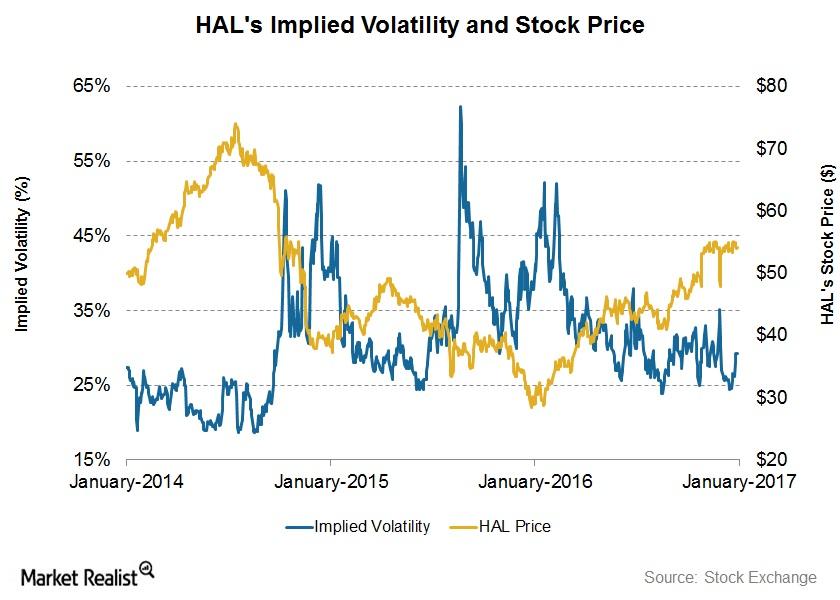

What Does Halliburton’s Implied Volatility Indicate?

On January 3, 2017, Halliburton (HAL) had implied volatility of ~29%. Since HAL’s 3Q16 financial results were announced on October 19, 2016, its implied volatility has remained nearly unchanged.

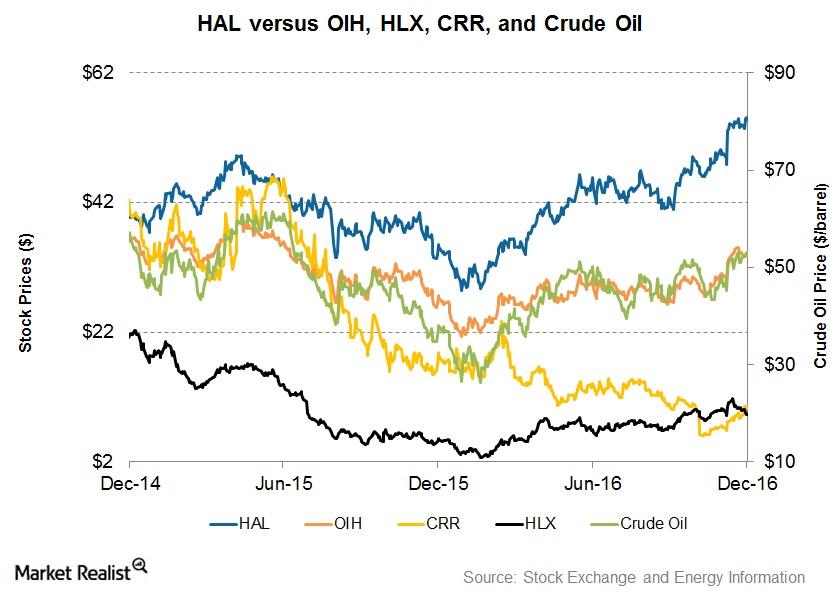

Analyzing Halliburton’s Stock Price Returns

From December 2014 to December 2016, Halliburton’s (HAL) stock price reached the highest level in December 2016. It troughed at ~$28 in January 2016.

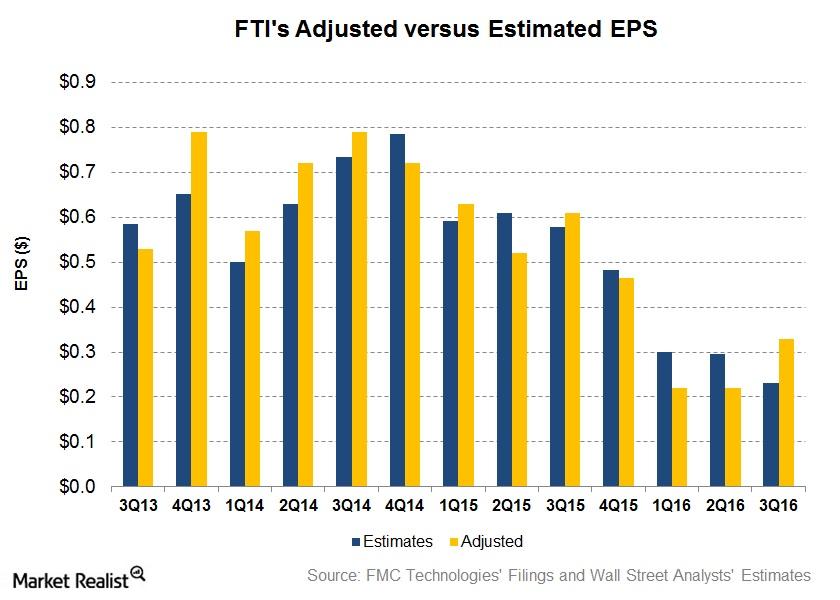

Why Did FMC Technologies’ 3Q16 Earnings Beat Estimates?

The 3Q16 adjusted net EPS (earnings per share) for FMC Technologies is $0.33. This exceeded sell-side analysts’ EPS estimates significantly by 43.0%.

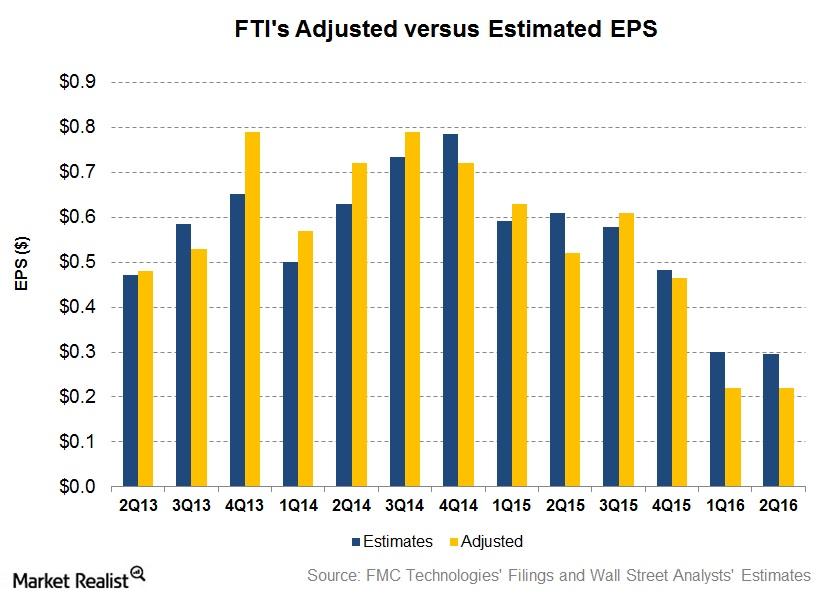

Why Did FMC Technologies’s 2Q16 Earnings Miss Estimates?

FMC Technologies (FTI) released its 2Q16 financial results on July 20. The company recorded total revenues of ~$1.2 billion in 2Q16, down by ~32% from ~$1.7 billion recorded in 2Q15.

What Are Nabors Industries’ Management Views for 2016?

Nabors Industries’ management expects high performance rigs to perform better when the energy market recovery starts.