GlaxoSmithKline’s Pharmaceuticals Segment Performance

Overall, the Pharmaceutical segment’s contribution to GSK’s total revenues was 57.7% in 2016.

March 29 2017, Updated 7:37 a.m. ET

Pharmaceuticals segment

GlaxoSmithKline’s (GSK) Pharmaceuticals segment declined substantially in 2015 due to the divestment of its Oncology business to Novartis (NVS) in March 2015. At constant exchange rates, the Pharmaceutical segment reported 3% growth in 2016 revenues at 16.1 billion pounds compared to ~14.2 billion pounds for 2015.

The growth was driven by increased sales of HIV products Triumeq and Tivicay, as well as its new pharmaceutical products, which were partially offset by lower sales of Seretide and Advair.

Overall, the Pharmaceutical segment’s contribution to GSK’s total revenues was 57.7% in 2016. Let’s look at the subsegments in the Pharmaceutical segment.

The Pharmaceuticals segment comprises various franchises, including HIV products; Respiratory products; Cardiovascular, Metabolic and Urology products; Immuno-inflammation products; and Established products. The total revenues for the Pharmaceutical segment include revenues from pharmaceuticals products as well as HIV products.

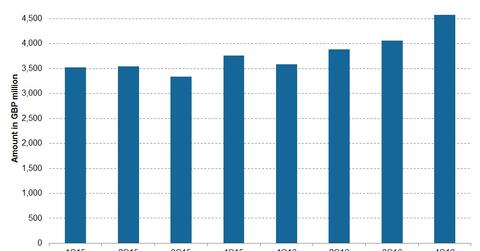

HIV products

The HIV products are marketed under ViiV Healthcare, a company in which GlaxoSmithKline is the major shareholder with an ~78.3% stake, while Pfizer (PFE) and Shionogi are other shareholders. HIV products reported 37% growth at constant exchange rates to ~3.6 billion pounds in 2016 compared to 2015.

Pharmaceuticals products

The Pharmaceuticals segment deals with Respiratory, Cardiovascular, Metabolic and Urology, Immuno-inflammation, and Established products. This segment reported revenues of ~12.6 billion pounds in 2016, excluding the revenues for HIV products.

To divest company-specific risk, investors can consider the PowerShares International Dividend Achievers ETF (PID), which holds 2.4% of its total assets in GlaxoSmithKline, 1.5% of its total assets in Sanofi (SNY), 1.1% of its total assets in Novartis (NVS), and 1.1% of its total assets in Teva Pharmaceuticals (TEVA).