Newmont’s Project Pipeline Remains Strong: What’s the Upside?

Newmont Mining is poised to overtake Barrick Gold as the world’s largest gold producer in 2018.

Nov. 20 2020, Updated 3:25 p.m. ET

Project pipeline

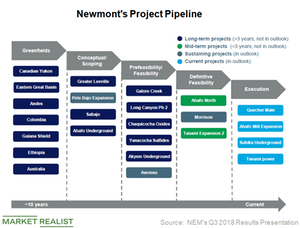

Future visibility on growth boosts stocks. For miners, project pipelines and past execution are key factors in determining future production.

Newmont Mining (NEM) has one of the best project pipelines in the sector (GDX) (GDXJ)—it may even be stronger than Kinross Gold’s (KGC), Barrick Gold’s (ABX), and AngloGold Ashanti’s (AU) project pipelines.

Newmont Mining is poised to overtake Barrick Gold as the world’s largest gold producer in 2018. For more information, read Barrick Gold versus Newmont: Comparing Miners in 2018 and Beyond.

Projects providing short- to medium-term returns

As we discussed, Newmont has already declared commercial production for two projects this year. In addition, it’s executing on four projects that will be completed before the end of 2019.

Newmont remains on track to reach commercial production at Subika Underground in the fourth quarter. The work at its Ahafo Mill Expansion is also ramping up and is expected to reach commercial production in the second half of 2019.

In South America, NEM’s Quecher Main project will extend oxide production. The company placed its first ore in September. Oxide production will be extended at Yanacocha. Newmont’s Tanami Power project in Australia, which is expected to reduce costs and emissions and facilitate future growth, is also progressing well. The two completed projects, as well as the four near-term projects, are expected to generate an average internal rate of return of over 20.0%.

Other projects included in the outlook

Among its longer-term projects, Newmont is advancing Long Canyon Phase 2 to a pre-feasibility study. It has also formed a partnership with Teck Resources (TECK), which owns the other half. NEM and TECK have started scoping the Galore Creek pre-feasibility studies.

NEM has also recently partnered with Evrim Resources to advance the exploration of Cuale, a prospective gold project in Mexico.

As we can see in the chart above, all sustaining and current projects are included in Newmont’s outlook, while mid- and long-term projects are excluded from its outlook. In the next article, we’ll discuss Newmont’s cost improvement strategy.