Natural Gas versus Natural Gas ETFs Last Week

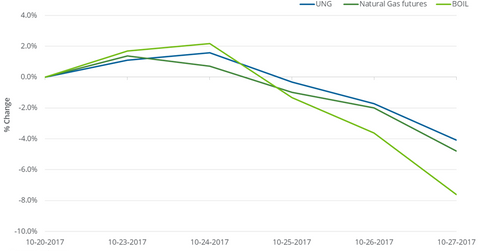

On October 20–27, natural gas (FCG) (GASL) (GASX) December futures fell 4.8%. During this period, the United States Natural Gas Fund LP (UNG) fell 4.1%.

Oct. 31 2017, Updated 12:46 p.m. ET

ETFs

On October 20–27, 2017, natural gas (FCG) (GASL) (GASX) December futures fell 4.8%. During this period, the United States Natural Gas Fund LP (UNG), which tracks natural gas near-month futures contracts, fell 4.1%. So, UNG fell less compared to natural gas futures last week.

The ProShares Ultra Bloomberg Natural Gas (BOIL) fell 7.6% in the week ending October 27, 2017. The large fall could be because of its stated goal to return twice the daily changes of the Bloomberg Natural Gas Subindex.

March 3, 2016

On March 3, 2016, natural gas active futures were at the lowest closing price in 17 years. Between March 3, 2016, and October 27, 2017, natural gas active futures rose 67.9%. Between these two dates, UNG rose 5.5% and BOIL fell 13.3%. The ETFs’ subdued returns could be due to a negative roll yield.

When an active futures contract’s expiry is within two weeks, UNG replaces its active futures holdings with the following month’s futures contracts. So, if natural gas’s expiring futures prices are lower than the following month’s futures contract, it could cause the ETFs’ returns to be impacted negatively. So, the roll yield would likely be negative.

BOIL’s daily price performance

In BOIL’s case, the compounding of BOIL’s daily price performance over a long duration could have caused the difference between its actual return and its targeted return.

On October 27, 2017, natural gas futures contracts out to February 2018 settled at progressively higher prices. Read Understanding the Natural Gas Futures Spread—And What It Means for Prices to learn more.