Pfizer on the Street: Analyst Recommendations after 2Q17

As of July 31, 2017, of the 22 analysts tracking Pfizer, ten recommend a “buy” for the stock, while 11 recommend a “hold,” and one recommends a “sell.”

Aug. 1 2017, Updated 7:41 a.m. ET

PFE’s analyst estimates

Wall Street analysts’ estimate that Pfizer’s (PFE) top line fell 0.5% to ~$13.08 billion in 2Q17. The company’s EPS (earnings per share) are expected to be $0.66 for the quarter.

Revenues are expected to be driven by lower sales of established products and the negative impact of foreign exchange, which should be substantially offset by an increase in the sales of products from the Innovative Health segment in 2Q17.

PFE’s analyst ratings

Pfizer’s stock price has fallen ~9.6% during the past 12 months but has risen ~2.1% YTD (year-to-date). The analysts’ estimates show that the stock has the potential to return ~12.8% over next 12 months.

The analysts’ recommendations show a 12-month target price of $37.40 per share, compared with its last price of $33.15 per share as on July 28, 2017.

PFE’s analyst recommendations

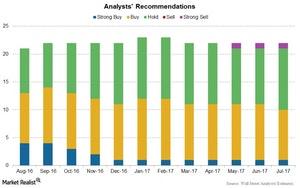

As of July 31, 2017, of the 22 analysts tracking Pfizer, ten recommend a “buy” for the stock, while 11 recommend a “hold,” and one recommends a “sell.” The consensus rating for Pfizer stands at 2.59, which represents a moderate buy for value investors.

Remember, the changes in analysts’ estimates and recommendations are based on changing trends in the stock’s price and the performance of the company.

To divest company-specific risks, investors can consider ETFs like the Fidelity MSCI Healthcare ETF (FHLC), which has 5.5% of its total assets in Pfizer. FHLC also has 10.0% of its total assets in Johnson & Johnson (JNJ), 2.6% in Bristol-Myers Squibb (BMY), and 2.8% in Gilead Sciences (GILD).