How Political Drama and ECB’s Dovish Statement Affected the Euro

The euro-dollar (FXE) pair closed the week ending October 27 at 1.16 against the US dollar (UUP).

Oct. 30 2017, Updated 12:40 p.m. ET

Euro sold aggressively after the ECB statement

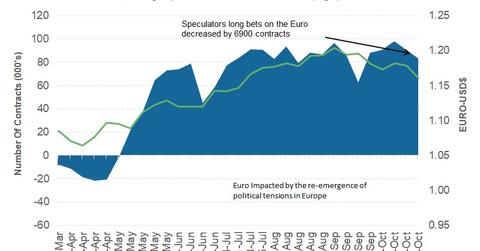

The euro-dollar (FXE) pair closed the week ending October 27 at 1.16 against the US dollar (UUP). The European currency was dragged lower after the European Central Bank (or ECB) statement confirmed that there wouldn’t be a rate hike at least until September 2018. The ECB reduced its monthly asset purchases to 30 billion euros starting January 2018 and extended the program until September 2018. Political troubles in Spain escalated after the Catalonian Parliament declared independence. Spanish Prime Minister Mariano Rajoy declared this move as a criminal act, fired the entire Catalonian government, and called for a new election on December 21.

European equity markets (VGK) gained momentum after the ECB confirmed that it wouldn’t raise rates for almost a year. The German DAX (DAX) ended the week higher by 1.7%, the Euro Stoxx (FEZ) was up 1.4%, and France’s CAC was up 2.3% in the previous week.

Euro speculators decrease their bets

As per the latest Commitment of Traders (or COT) report released on Friday, October 27, by the Chicago Futures Trading Commission (or CFTC), speculators reduced their bullish positions on the euro for a second week in a row. The total net speculative bullish positions on the euro (EUFX) fell to 83,504 contracts from 90,452 contracts as of October 24. Speculators are likely to turn bearish as the ECB has clearly communicated its intentions to leave rates unchanged.

Outlook for euro

The European currency is likely to remain under pressure due to political uncertainty in the region. Economic data, though important, is unlikely to have any major positive impact on the euro this week. With the US dollar now seeming poised for another upward rally, preference could be given to the US dollar, leading to further losses for the euro.

In the next part of this series, we’ll discuss why speculators are turning bearish on the British pound.