How Is UPS Valued Compared to Its Peers?

UPS’s forward PE ratio stands at 17.1x compared to its current PE ratio of 22.3. Analysts are expecting UPS’s earnings to grow in the next four quarters.

Nov. 20 2020, Updated 11:33 a.m. ET

Forward PE ratio

We covered UPS’s 2Q15 results earlier in this series. In this part, we’ll discuss the company’s valuation compared to its peers.

We’ll use the forward PE (price-to-earnings) multiple to gauge UPS’s valuation. The forward PE ratio is the stock’s current price divided by the next 12-month earnings estimate. A forward PE ratio that’s less than the current PE ratio indicates an expected increase in earnings. This ratio helps us understand companies’ valuation with a focus on future growth rather than past performance.

Currently, UPS’s forward PE ratio stands at 17.1x compared to its current PE ratio of 22.3. This means that analysts are expecting UPS’s earnings to grow in the next four quarters.

Compared to its peers

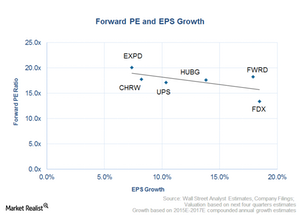

In the above chart, UPS is compared to its peers. FedEx (FDX) is its biggest and closest competitor. C.H. Robinson Worldwide (CHRW), Expeditors International (EXPD), Hub Group (HUBG), and Forward Air (FWRD) are logistics providers. They offer indirect competition to UPS.

- UPS’s earnings are expected to grow by 10.30% in the next two years. Currently, it’s trading at 17.12x.

- FedEx has the highest EPS (earnings per share) growth expectations at 18.50%. However, it has the lowest valuation compared to its peers. Its forward PE ratio stands at 13.39.

- C.H. Robinson Worldwide is trading at 17.12x, Expedia is at 17.74x, Hub Group is at 17.55x, and Forward Air is at 18.22x.

- Looking at the above chart, UPS seems to be fairly valued compared to its peers.

UPS forms a 7.60% holding in the iShares Transportation Average ETF (IYT).

For more updates, please visit Market Realist’s Courier Services page.