How Higher Crude Oil Prices Impact Coal Producers

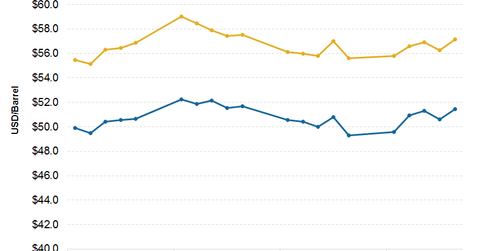

On October 13, 2017, Brent crude oil prices settled at $57.17 per barrel, 3% higher than $55.60 reported during the previous week.

Oct. 18 2017, Updated 10:41 a.m. ET

Crude oil prices

On October 13, 2017, Brent crude oil prices settled at $57.17 per barrel, 3% higher than $55.60 reported during the previous week.

The WTI (West Texas Intermediate) crude oil price settled at $51.50 per barrel on October 13, 2017. This price was 4% higher than $49.29 per barrel when the market closed on October 6, 2017.

Is crude oil’s price a driver for coal producers?

Movements in crude oil prices impact coal companies (KOL) like Alpha Natural Resources (ANRZQ), Westmoreland Coal (WLB), and Peabody Energy (BTU) in a variety of ways. Crude oil’s price is a mixed driver for the coal industry, although crude oil and coal are not direct competitors.

Crude oil’s price is a key metric in natural gas production. Previously, we read that shifts in natural gas inventory or prices impact coal prices.

Crude oil is also a primary component in the coal mining process. If oil prices fall, crude oil producers are forced to cut down production in order to avoid losses.

Lower oil inventory suggests more rail infrastructure that becomes available for coal transportation. Using railroads for transportation helps coal companies reduce their operating costs.

Unlike its involvement in natural gas production and coal mining process in the US, crude oil does not have a major role in electricity generation. So, crude oil price movements do not significantly impact utilities like Duke Energy (DUK) and Southern Company (SO).

Next, let’s look at the recent coal inventory levels.