How Is Novartis’s Lucentis Positioned after 1H17?

In 1H17, Novartis’s (NVS) Lucentis reported revenues of around $922 million, which is a ~1% decline on a year-over-year (or YoY) basis.

Sept. 18 2017, Published 2:20 p.m. ET

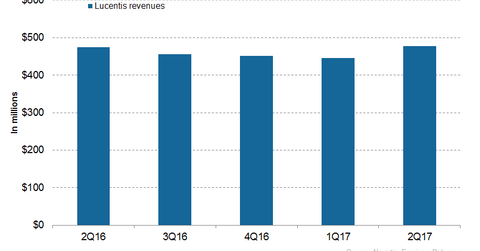

Lucentis revenue trends

In 1H17, Novartis’s (NVS) Lucentis reported revenues of around $922 million, which is a ~1% decline on a year-over-year (or YoY) basis. In 2Q17, Lucentis generated revenues of around $477 million, which reflected ~7% growth on a quarter-over-over (or QoQ) basis.

About Lucentis

Lucentis (ranibizumab) is used for the treatment of individuals with neovascular (or wet) age-related macular degeneration (or AMD), macular edema after retinal vein occlusion (or RVO), diabetic macular edema (or DME), diabetic retinopathy (or DR), and myopic choroidal neovascularization (or mCNV).

Higher levels of vascular endothelial cell growth factor-A (or VEGF-A) is observed in individuals with neovascular AMD, DME, and RVO. VEGF-A is a signal protein that helps in the formation of blood vessels, but overexpression of the VEGF-A leads to different clinical conditions. Ranibizumab inhibits all biologically active forms of VEGF-A.

In September 2017, Novartis presented new data from the phase 4 head-to-head RIVAL trial confirming efficacy and durability of Lucentis in the treatment of individuals with neovascular AMD. The phase four head-to-head RIVAL trial compared ranibizumab with aflibercept utilizing a treat-and-extend regimen in individuals with neovascular AMD.

In the phase four RIVAL study, at 12 months, patients on Lucentis 0.5 mg demonstrated clinically significant enhancements in vision, calculated as Best Corrected Visual Acuity (or BCVA). Patients on Lucentis 0.5mg demonstrated a 7.1 letter gain compared to a 4.9 letter gain for patients on aflibercept 2.0 mg.

Novartis is conducting clinical trials for label expansion of Lucentis. Presently, Novartis is conducting its phase 3 RAINBOW trial to evaluate whether intravitreal ranibizumab is clinically superior to laser ablation therapy for the treatment of retinopathy of prematurity (or ROP).

Novartis’s Lucentis competes with Regeneron Pharmaceuticals’ (REGN) Eylea. Novartis’s peers in the ophthalmology drugs market include Roche (RHHBY), Valeant Pharmaceuticals, Bayer (BAYZF), Allergan (AGN), Regeneron Pharmaceuticals, and others. The growth in sales of Novartis’s Lucentis could boost the BLDRS Europe Select ADR Index Fund (ADRU). Novartis makes up about ~6.7% of ADRU’s total portfolio holdings.