Impact of currency fluctuation on China Eastern’s profitability

Chinese companies are vulnerable to exchange rate fluctuations, especially against the US dollar, and they have a high amount of debt denominated in US dollars.

Dec. 24 2014, Updated 1:39 p.m. ET

Exposure to US dollar

Chinese companies are vulnerable to exchange rate fluctuations, especially against the US dollar, and they have a high amount of debt denominated in US dollars. This is a result of comparatively lower interest rates in the US than in China. The US Federal Reserve maintains lower interest rates in order to add liquidity to the system.

Currency fluctuations also have an impact on purchase cost of jet fuel and aircraft that are denominated in US dollars. As a result, the operating and net margins of the major Chinese airline companies are dependent on fluctuations in exchange rates.

Impact on profitability

China Eastern’s (CEA) operating margin was 1.8% and net margin was higher (2.7%) primarily due to exchange rate gains from appreciating currency. Net interest expense amounted to 1,400 million renminbi, but the exchange gain amounted to 1,976 million renminbi, resulting in a net addition of 576 million renminbi to its operating profit.

However, the gains or losses reported by airlines each year fluctuate widely due to the volatile nature of changing exchange rates. China Eastern (CEA) recorded a net exchange gain of only 148 million renminbi in FY12. China Southern (ZNH) recorded a net exchange gain related to the translation of borrowings and financial lease obligations that were denominated in US dollars of 2,903 million renminbi in FY13, compared to only 267 million renminbi in FY12.

Currency

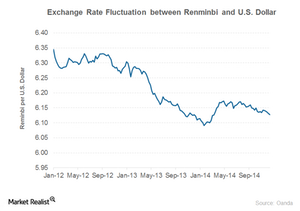

Between FY09 and FY13, renminbi appreciated from 6.83 per USD to 6.15 per USD. In 2014, however, the gains were reversed as the currency started depreciating since February 2014, severely impacting the profitability of all airline companies in China.

Comparatively, US airlines are at a competitive advantage, as they are less exposed to currency fluctuations compared to airlines in other regions. All major US airlines have lower fuel costs, including Delta Air Lines (DAL), United Continental Holdings (UAL), Alaska Air Group (ALK), JetBlue Airways (JBLU), and Southwest Airlines (LUV).

Even Brazilian airlines have higher fuel costs and huge debt in foreign currency. Refer to our series on GOL Linhas Aereas Inteligentes SA: Financials and operations for an overview of the Brazilian airline.