How Crude Oil Indirectly Impacts Coal Prices

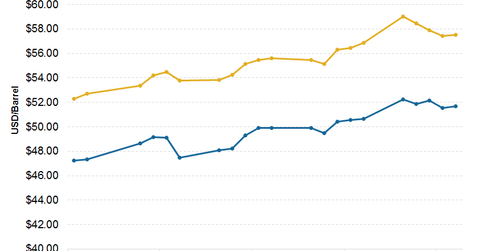

On September 29, 2017, Brent crude oil prices closed at $57.54 per barrel compared to $56.86 the previous week.

Oct. 4 2017, Updated 4:06 p.m. ET

Crude oil prices

On September 29, 2017, Brent crude oil prices closed at $57.54 per barrel compared to $56.86 the previous week.

The price for WTI (West Texas Intermediate) crude oil closed at $51.67 per barrel on September 29, 2017. That was higher than $50.66 per barrel when the market closed on September 22, 2017.

Link between crude oil price and coal producers

Even though coal and crude oil don’t directly compete with each other, coal producers (KOL) such as Arch Coal (ARCH), Alpha Natural Resources (ANRZQ), Peabody Energy (BTU), and Cloud Peak Energy (CLD) are impacted in various ways by the fluctuations in crude oil prices, which can be considered a mixed driver for the coal industry.

Oil pricing is a driving force for natural gas production trends. As we saw in the earlier parts of this series, any fluctuations in natural gas inventory or prices have a huge impact on coal.

Oil is a fundamental component in the coal mining process. Weak oil prices pressure crude oil producers to cut down production. A fall in oil production leads to more accessible rail infrastructure to transport coal. It helps coal producers reduce their operating costs.

Since oil is a primary component in electricity generation in the United States, the impact of oil price fluctuations on utilities such as Duke Energy (DUK) and Southern Company (SO) is mostly insignificant.

Next, let’s look at declining coal production.