Futures Spread: Does It Signal End of Oil’s Oversupply Concern?

On October 17, 2017, US crude oil (USO) (OIIL) December 2018 futures traded $0.46 below the December 2017 futures.

Nov. 20 2020, Updated 12:15 p.m. ET

Futures spread

On October 17, 2017, US crude oil (USO) (OIIL) December 2018 futures traded $0.46 below the December 2017 futures. The spread between these two futures contracts is known as the futures spread. On that same day, the futures spread was at a discount of $0.46. However, on October 10, 2017, the futures spread was at a premium of $0.09. From October 10–17, 2017, US crude oil December futures rose 1.7%.

During backwardation

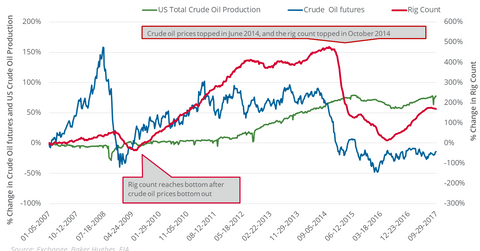

During backwardation, the futures spread is at a discount. When the discount expands, US crude oil futures may rise. However, when the discount contracts, US crude oil prices may fall. For example, on June 20, 2014, the discount reached $10.53. On the same day, US crude oil active futures were at their peak just before there was a three-year fall in oil prices.

During contango

During contango, the futures spread is at a premium. When the premium expands, US crude oil futures may fall. However, when the premium contracts, US crude oil prices may rise. For example, on February 11, 2016, the premium reached $12.01. On the same day, US crude oil active futures were at their 12-year low.

In the trailing week, the futures spread shifted from contango to backwardation. US crude oil futures rose during that same period. It could signal the end of oversupply concerns in the oil market.

Energy stocks

Hedging decisions of US oil producers (XOP) (DRIP) (IEO) could depend on US crude oil futures’ forward curve. During backwardation, oil producers find that selling current production at the current prices is more profitable than storing it and selling it at a future date for lower prices. It also impacts midstream (AMLP) oil transportation and storage businesses.

On October 17, 2017, US crude oil futures contracts for delivery until April 2018 settled at progressively higher prices. Given the upward-sloping futures forward curve, ETFs that are meant to track US crude oil futures could return less compared to oil futures. That could explain the underperformance of the United States 12 Month Oil ETF (USL), the United States Oil ETF (USO), and the ProShares Ultra Bloomberg Crude Oil (UCO) compared to US crude oil futures.