Comparing Microsoft’s and Peers’ Cash Reserves

Tax reforms for repatriation of US companies’ cash reserves Previously, we discussed the rationale behind Trump’s proposed tax reforms, which aim to lure US companies back to the country. According to Goldman Sachs (GS), if the Republicans manage to pass the tax legislation, US companies (SPY) (SPX) are expected to repatriate $250 billion in foreign profits. Technology […]

Oct. 31 2017, Updated 4:03 p.m. ET

Tax reforms for repatriation of US companies’ cash reserves

Previously, we discussed the rationale behind Trump’s proposed tax reforms, which aim to lure US companies back to the country. According to Goldman Sachs (GS), if the Republicans manage to pass the tax legislation, US companies (SPY) (SPX) are expected to repatriate $250 billion in foreign profits. Technology companies would lead the way with their billion-dollar cash reserves.

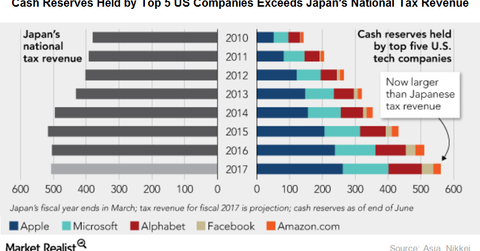

Leading tech companies’ cash reserves exceed Japan’s national tax revenue

The above presentation from Nikkei Asian Review shows that Apple’s (AAPL), Facebook’s (FB), Alphabet’s (GOOG), Amazon’s (AMZN), and Microsoft’s (MSFT) combined cash reserves surged from ~$150 billion in 2010 to an astonishing $560.1 billion at the end of June 2017. These technology companies’ total cash reserves exceeded the Japanese government’s (EWJ) overall tax revenue in fiscal 2016.

As of June 2017, Apple’s cash reserves stood at $261.5 billion, while Microsoft and Alphabet had cash reserves of $139 billion and $101.3 billion, respectively. By keeping their cash and equivalents overseas, technology companies can avoid high corporate taxes in the United States. Through tax reforms, the Trump administration aims to bring funds back into the country.