Is Barrick Gold behind in Achieving Its Unit Cost Target?

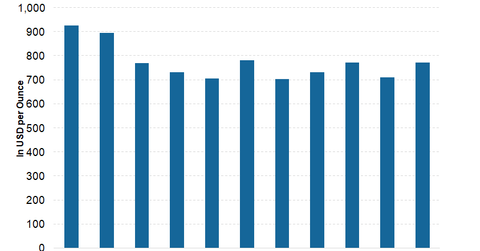

Barrick Gold (ABX) reported AISC (all-in sustaining costs) of $772 per ounce in 3Q17, which is 10% higher year-over-year and 9% higher sequentially.

Oct. 30 2017, Updated 7:34 a.m. ET

Barrick’s AISC

Barrick Gold (ABX) reported AISC (all-in sustaining costs) of $772 per ounce in 3Q17, which is 10% higher year-over-year and 9% higher sequentially. Higher unit costs were mainly due to the planned increase in mine site sustaining capital expenditures at Barrick Nevada and Veladero and fewer ounces sold. Higher costs of sales per ounce also contributed to higher AISC for the company.

While the company reported an increase in unit costs in 3Q17, it’s quite competitive in AISC relative to peers. It’s the lowest-cost senior gold producer, with costs lower than major peers (RING) Newmont Mining (NEM), Agnico Eagle Mines (AEM), and Kinross Gold (KGC).

Cost guidance and focus on lowering costs

In line with narrowing production guidance, Barrick narrowed its AISC guidance from $720–$770 per ounce to $740–$770 per ounce in its 3Q17 results. The new guidance implies a mid-point guidance of $755 per ounce. Earlier, the company was aiming to achieve AISC of $700 per ounce by 2019. While answering a question regarding its target of reaching AISC of $700 per ounce by 2019, Richard Williams, Barrick’s chief operating officer, said it would be a longer process than they had “originally envisioned.” He added that it would require investment in design, training, scaling, and roll-out. While it might take longer for the company to reach its targeted AISC, it has made solid progress in bringing down costs over the last few years.

In the next part of this series, we’ll look at Barrick Gold’s financial leverage.