What Analysts Are Forecasting for Gold Miners’ 3Q17 Earnings

Analysts expect Barrick Gold’s (ABX) EBITDA to fall 17% YoY in 3Q17 to $988 million.

Oct. 20 2017, Updated 7:44 a.m. ET

Earnings estimates

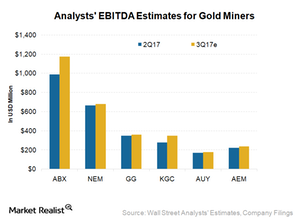

After looking at the analysts’ revenue estimates, let’s discuss what analysts expect for these gold miners’ (RING) earnings. As we saw in the previous part of this series, Barrick Gold’s (ABX) revenues are expected to decline in 3Q17 and 2017. This trend is also visible in the analysts’ EBITDA[1. earnings before interest, tax, depreciation, and amortization] estimates.

Analysts expect ABX’s EBITDA to fall 17% YoY in 3Q17 to $988.0 million. The estimates for the fiscal year, however, imply 12.2% growth.

Kinross Gold and Newmont Mining

Kinross Gold’s (KGC) earnings estimates imply an 18.4% decline for 3Q17. This drop is also in line with the company’s guided fall in revenues.

While analysts forecast a slight decline for Newmont Mining’s (NEM) EBITDA in 3Q17, its earnings are expected to show 10.2% growth in 2017. Higher revenues and lower costs should lead to an increase in EBITDA.

Agnico Eagle Mines, Goldcorp, and Yamana Gold

The 3Q17 EBITDA estimate for Agnico Eagle Mines (AEM) is $222.0 million, implying a 41.0% margin. The margins are expected to be 42.5% for 2017.

Analysts forecast Goldcorp’s (GG) 3Q17 EBITDA to decline 10.3% YoY in 3Q17 to $350.0 million. This downtrend was expected, as revenues are also expected to fall 7.3% in 3Q17.

Yamana Gold (AUY) is expected to report 37% higher EBITDA sequentially in 3Q17 at $168.7 million. However, its EBITDA in 2017 is expected to fall 5.0% YoY to $594.0 million in 2017.

In the next part, we’ll look at the free cash flow expectations for these miners.