Alcoa Continues Its Rally as China Keeps Its Commitment

China exported 370,000 metric tons of unwrought aluminum in September, compared to 410,000 metric tons in August.

Oct. 16 2017, Updated 2:06 p.m. ET

Alcoa

Previously in this series, we looked at China’s September steel exports. Like steel, aluminum faces the issue of chronic oversupply, especially in China.

As with the steel industry, China plans to curtail some of its aluminum capacity to mitigate the country’s rising pollution levels. In this article, we’ll look at China’s aluminum exports in September.

Chinese aluminum exports

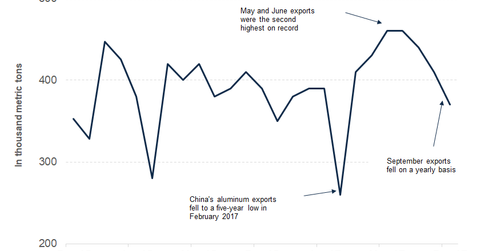

China exported 370,000 metric tons of unwrought aluminum in September, compared to 410,000 metric tons in August. China’s September aluminum exports have fallen 5.1% year-over-year (or YoY). In August 2017, China’s aluminum exports were similar to August 2016.

Before that, the country’s aluminum exports rose YoY for four consecutive months, including a double-digit yearly rise in June and July. In the first nine months of 2017, China’s aluminum exports totaled ~3.6 million metric tons—4.6% higher than the same period in 2016.

Chinese curtailments

Notably, China plans to curtail some of the polluting smelters in the winter months. We have also seen a decline in Chinese aluminum production (ACH) (FXI).

In absolute terms, China’s August aluminum production was the lowest since April 2016. This trend ignores February 2017 when production fell due to fewer days and China’s Lunar New Year holidays. August 2017 marked the first time since August 2016 that China’s aluminum production registered a yearly fall.

Lower Chinese aluminum exports are positive for producers like Alcoa (AA), Century Aluminum (CENX), and Norsk Hydro (NHYDY). Companies like Alcoa have moved to higher price levels this year, following aluminum prices. Expectations of Chinese curtailments have been among the key drivers of aluminum’s upward price action.

In the final article in this series, we’ll look at China’s copper imports data.