A Review of Pharma Stocks’ EPS Growth Rates

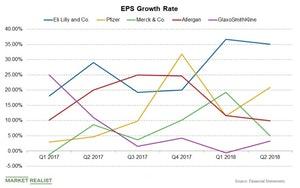

In this article, we’ll compare the EPS growth rates of Eli Lilly (LLY), Pfizer (PFE), Merck & Co. (MRK), Allergan (AGN), and GlaxoSmithKline (GSK).

Sept. 18 2018, Updated 10:31 a.m. ET

EPS growth rates

In this article, we’ll compare the EPS growth rates of pharmaceutical companies Eli Lilly and Company (LLY), Pfizer (PFE), Merck & Co. (MRK), Allergan (AGN), and GlaxoSmithKline (GSK).

The chart above compares the EPS growth rates of these companies since the first quarter of 2017.

Eli Lilly

Eli Lilly reported a ~35.1% rise in its EPS in the second quarter. Its adjusted EPS rose to $1.50 in the quarter compared to its EPS of $1.11 in the second quarter of 2017.

Pfizer

Pfizer reported a ~20.9% rise in its EPS in the second quarter. Its adjusted EPS rose to $0.81 in the quarter compared to its EPS of $0.67 in the second quarter of 2017.

Merck & Co.

Merck & Co. reported a ~4.9% rise in its EPS in the second quarter. Its adjusted EPS rose to $1.06 in the quarter compared to its EPS of $1.01 in the second quarter of 2017.

Allergan

Allergan reported a ~9.9% rise in its EPS in the second quarter. Its adjusted EPS rose to $4.42 in the quarter compared to its EPS of $4.02 in the second quarter of 2017.

GlaxoSmithKline

GlaxoSmithKline reported a ~3.3% rise in its EPS in the second quarter. Its adjusted EPS rose to 28.10 British pence in the quarter compared to its EPS of 27.20 pence in the second quarter of 2017.

We’ll discuss the quarterly revenue performances of and 2018 estimates for each of these companies in the coming articles.

The iShares US Healthcare ETF (IHE) holds 6.9% in Eli Lilly, 9.3% in Pfizer, 8.2% in Merck & Co., and 5.7% in Allergan.