Why Was the Euro a Silent Spectator Last Week?

As per the latest Commitment of Traders (or COT) report, released on Friday, September 15 by the Chicago Futures Trading Commission (or CFTC), speculators turned bullish on the euro during the week.

Sept. 18 2017, Updated 9:37 a.m. ET

Lack of economic data left euro directionless last week

The euro (FXE) closed the week ending September 15 at 1.2 against the US dollar (UUP). The shared currency gave up some of its gains as the US dollar and the British pound dominated the markets last week. There were no major economic data releases from the Eurozone in the entire week, which added to the directionless movement in the shared currency. The lack of economic data didn’t lead to a sell-off in the currency, as expectations for monetary tightening from the ECB lent support to the euro.

European equity markets (VGK), baring the FTSE 100, remained in positive territory in the previous week. During the week, the German DAX (DAX) rose 0.35%, the Euro Stoxx (FEZ) rose 0.56%, and France’s CAC rose 0.72% in the previous week.

Euro speculators increase their bets

As per the latest Commitment of Traders (or COT) report, released on Friday, September 15 by the Chicago Futures Trading Commission (or CFTC), speculators turned bullish on the euro during the week.

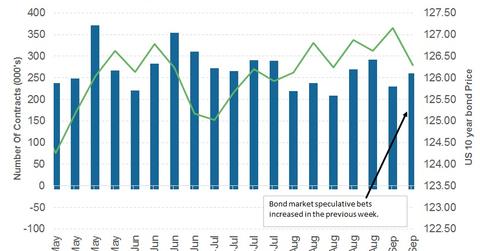

The total net speculative bullish positions on the euro (EUFX) fell from 96,309 contracts through September 5 to 86,058 as of September 12. This was a minor reduction in bullish sentiment and could be a result of some profit booking by investors after the euro scaled a three-year peak.

Will the euro bounce back this week?

The focus will be on the US FOMC meeting this week. Any signs of hawkishness from the FOMC statement could prompt a sell-off in the European currency. That doesn’t mean we’ll likely see a continued slide, as markets may now be looking at the US Fed, ECB, and the Bank of England, as the hawkish trio and flows into each of these currencies could determine the price action.

Economic data releases from the Eurozone this week include the ZEW economic sentiment, inflation, and purchasing managers’ indexes for the manufacturing and services sector. ECB president Mario Draghi is scheduled to speak at two different meetings on Thursday and Friday.

In the next part of this series, we’ll analyze the surprise rise of the British pound.