Why Maturity Bonds Reacted Differently to the Fed’s September Statement

The Fed’s balance sheet has $4.4 trillion in bond market securities, and it intends not to reinvest a small portion of the maturing securities every month.

Sept. 22 2017, Updated 9:10 a.m. ET

Bond markets reaction to the FOMC statement

FOMC (Federal Open Market Committee) members signaled the beginning of the Fed balance sheet unwinding program in the committee’s latest meeting on September 20. The Fed’s balance sheet has $4.4 trillion in bond market (BND) securities, and it intends not to reinvest a small portion of the maturing securities every month.

This announcement was expected by markets, and so it didn’t have any major impact on bond markets. The Fed will continue to be one of the largest purchasers of bonds every month, and it will be reinvesting large sums every month.

Why did bond markets fall after the Fed’s latest statement?

The main reason behind the fall in bonds was the hawkishness of the Fed, which increased the probability of another rate hike in December. When interest rates are expected to increase, bond prices fall because their present values are derived based on interest rates.

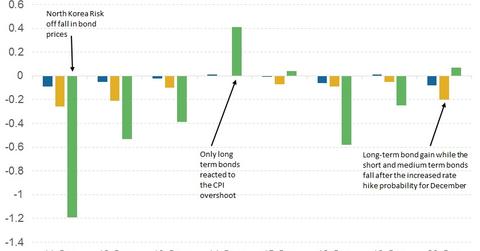

The reaction in the bond markets, however, was not uniform. The two-year yield (SHY) rose 37.0 basis points (or ~2.6%), while ten-year yield (IEI) rose 27.0 basis points (or ~1.2%), and the 30-year yield (TLT) fell 4.0 basis points (or 0.14%).

Why was there an uneven reaction in bond yields?

The reason there was an uneven reaction across the yield curve is that there was a difference between inflation (TIP) and interest rate expectations. Fed Chair Janet Yellen stated that low inflation would be transitory, but it appears that markets believe otherwise.

Markets are now pricing in that the Fed could increase rates in the short term, but in the long run, it could be difficult for the Fed to increase rates.

In the next and final part of this series, we’ll discuss the gains in the US Dollar Index after the Fed’s latest statement.